| PERCENT OF PROCEEDS GAS PURCHASE AGREEMENT By and Between IACX Roswell LLC And Solis Partners, LLC June 1, 2021 IACX ROSWELL CONTRACT NO. ROS21 001 CONFIDENTIAL |

| Table of Contents ARTICLE 1 -Term, Dedication and Receipt Points............................................................................1 ARTICLE 2- Right to Process and Market..........................................................................................1 ARTICLE 3-Take Quantity...................................................................................................................2 ARTICLE 4- Allocation .........................................................................................................................2 ARTICLE 5 - Consideration and Fees..................................................................................................3 ARTICLE 6 - Responsibility for Well Connections.............................................................................9 ARTICLE 7 - Expansion of Existing Facilities ....................................................................................9 ARTICLE 8 - Termination ....................................................................................................................9 ARTICLE 9 – Notices.............................................................................................................................10 ARTICLE 10 -Miscellaneous.................................................................................................................10 ARTICLE 11 - Entire Agreement .........................................................................................................11 List of Exhibits EXHIBIT A - Dedicated Properties - i - |

| PERCENT OF PROCEEDS GAS PURCHASE AGREEMENT This Gas Purchase Agreement ("Agreement") is entered into and made effective on this first day of June, 2021 ("Effective Date"), between Solis Partners, LLC, a Texas limited liability company, whose address is P.O. Box 5790, Midland, Texas 79704 ("Producer"), and IACX Roswell LLC, a Delaware limited liability company, whose address is 5001 Lyndon B. Johnson Fwy., Suite 300, Dallas, Texas 75244 ("IACX" or "Purchaser"). Producer and IACX are collectively referred to as the “Parties” and individually as "Party". RECITALS The Parties represent as follows: Producer owns or otherwise controls supplies of gas which it desires to sell. IACX desires to purchase Producer's Gas at the Receipt Points listed on Exhibit A on the following terms and conditions. NOW THEREFORE, the Parties agree as follows: TERM This Agreement takes effect on the Effective Date and remains in full force and effect through and including May 31, 2024 ("Primary Term"), and on a Month to Month basis thereafter unless and until terminated by either Party upon thirty (30) Days’ prior written notice. ARTICLE 1 DEDICATION, AND RECEIPT POINTS 1.1 Subject to the terms and conditions of this Agreement, including the General Terms and Conditions provisions and any attachments or exhibits, Producer agrees to deliver and sell to IACX, and IACX agrees to receive and purchase from Producer, all gas owned or controlled by Producer and produced from the wells and acreage listed on Exhibit A ("Dedicated Properties") of this Agreement and any new wells drilled and completed thereon. 1.2 IACX shall have no duty to purchase Gas attributable to production from interests of third parties that has been purchased by Producer for resale, except that IACX will purchase Gas attributable to working and mineral interests owned by third parties in wells operated by Producer that are subject to this Agreement that Producer has the right to market under an operating agreement or oil and gas lease. ARTICLE 2 RIGHT TO PROCESS AND MARKET 2.1 Producer hereby grants to IACX the exclusive right to (i) process Producer's Gas delivered hereunder for the extraction of natural gas liquids and other valuable components and (ii) market all Plant Products, Plant Condensate and Residue Gas attributable to Producer's Gas. - 1 - |

| 2.2 IACX may recover Plant Products under this Agreement at the Plant or at other plants at which IACX or an affiliate of IACX has contracted services. ARTICLE 3 TAKE QUANTITY 3.1 Subject to the terms and conditions of this Agreement, including the General Terms and Conditions provisions and any attachments or exhibits, IACX agrees to receive and purchase and Producer agrees to deliver and sell all the Gas volumes from the Dedicated Properties. Producer will install, own and maintain at its sole cost and expense, facilities to effectuate delivery into IACX's facilities, including overpressure protection on either the wellhead or production separator designed to prevent delivery of Gas at pressures exceeding the Facilities’ Maximum Allowable Operating Pressure ("MAOP") of 1,000 psig. 3.2 Release of Gas. Although there is no specific take quantity, IACX will diligently operate or cause operation of the facilities in an effort to maintain consistent takes of all available quantities. If IACX takes less than the full and available quantity of gas from the Dedicated Properties, IACX will take the gas ratably according to the schedule in the General Terms and Conditions Section 3, and Producer shall have the right to dispose of any gas not taken by IACX subject to recall by IACX at the beginning of the month following thirty (30) days prior written notice. For purposes of determining the order of curtailment, if any, in Section 3 of the General Terms and Conditions, this Agreement is an acreage dedication. 3.3 IACX shall have the right to interrupt the purchase of Gas or the providing of services when necessary to test, alter, modify, enlarge, or repair any facility or property comprising a part of, or appurtenant to, IACX's facilities, or otherwise related to the operation thereof. IACX shall endeavor to cause a minimum of inconvenience to Producer and, except in cases of emergency, shall endeavor to give Producer a minimum of forty-eight (48) hours advance notice of its intention to so interrupt the purchase of Gas or the providing of services and of the expected magnitude of such interruptions. ARTICLE 4 ALLOCATION 4.1 Allocation of Plant Products, Plant Condensate, and Residue Gas. In order to calculate consideration due Producer hereunder, IACX will perform allocations of Residue Gas, Plant Condensate, and Plant Products each month. IACX will determine the Plant Products, Plant Condensate, and Residue Gas allocable to Producer using the following definitions and procedures. From time to time, IACX may make changes and adjustments in its allocation methods to improve accuracy. (a) Plant Products Allocable to Producer. The quantity of each Plant Product component allocable to Producer's gas will be determined by multiplying the total quantity of that component sold at the Plant by a fraction. The numerator of such fraction is the theoretical gallons of that Plant Product component contained in the Gas delivered by Producer at the Receipt Point(s), determined by (a) multiplying the GPM of such NGL - 2 - |

|

|

|

|

|

|

| ARTICLE 6 RESPONSIBILITY FOR WELL CONNECTIONS (a) Producer shall provide, at its own expense, the necessary equipment and labor to construct, install and connect pipeline(s) (“Producer’s Pipeline”) for gathering Producer's Gas from any new wells located on the Dedicated Properties that are completed after the Effective Date and to transport such Gas to a Receipt Point covered by this Agreement or a new Receipt Point to be mutually agreed upon by the Parties. (b) Producer shall own, operate, maintain, abandon, and remove Producer’s Pipeline in compliance with applicable laws. (c) Upon termination of this Agreement, Producer shall disconnect Producer’s Pipeline from IACX’s Facilities. ARTICLE 7 EXPANSION OF EXISTING FACILITIES [Intentionally Omitted]. ARTICLE 8 TERMINATION 8.1 In addition to any other termination rights granted to IACX in this Agreement including the General Terms and Conditions, in the event it has been unprofitable, as defined in this Article, for a period of at least three (3) consecutive Months for IACX to operate its Facilities to gather, Process, or compress Producer's Gas from the Receipt Points covered by this Agreement, and IACX reasonably determines that the receipt of Producer's Gas or operation of its Facilities to accommodate Producer's Gas from Receipt Points hereunder will likely continue to be unprofitable, IACX shall have the right to give Producer a written notice of unprofitability, which notice shall include sufficient documentation to substantiate the claim of unprofitability. Upon Producer's receipt of IACX's notice, the Parties shall then attempt in good faith to negotiate mutually acceptable terms to provide for continued delivery of Gas hereunder. If the Parties cannot agree on those terms within thirty (30) days following the notice of unprofitability, then IACX may terminate this Agreement prior to the expiration of said thirty (30) day period, which termination shall be effective not less than fifteen (15) days from the date of the notice, and if IACX does not provide notice of its election to terminate the Agreement prior to the expiration of said thirty (30) day period, the Agreement will continue in full force and effect without modification. 8.2 IACX's operations hereunder are defined as unprofitable if IACX's fees stipulated in Article 5, plus IACX’s net revenues (defined as the revenue received from unaffiliated third parties under arms-length transactions fob IACX’s Facilities) from helium attributable to Producer's Gas delivered at the Receipt Point(s), do not exceed the sum of: (i) IACX's expenses attributable to - 9 - |

| Producer's Gas delivered at the Receipt Points hereunder plus (ii) five cents ($0.05) per MMBtu for each MMBtu of Producer's Gas delivered at the Receipt Point(s) hereunder. ARTICLE 9 NOTICES 9.1 All noticesrequired in this Agreementshall be in writing and shall be considered as havingbeen given if delivered by mail, .pdf via email or FAX to either IACX or Producer at the designated address. Normal operating instructions can be delivered by telephone or other agreed to means. Notice of Events of Force Majeure may be made by telephone and promptly confirmed in writing. Monthly statements, payments, and any communications shall be considered as delivered when received at the addresses listed below or to such other address as either party shall designate in writing: IACX: Producer: IACX Roswell, LLC Solis Partners, LLC 5001 LBJ Freeway, Suite 300 P.O. Box 5790 Dallas, Texas 75244 Midland, Texas 79704 FAX: (972) 960-3215 FAX: Email: jeremyjordan@iacx.com Email: will.gray@solispartnersllc.com ARTICLE 10 MISCELLANEOUS 10.1 To the extent operations with respect to any wells located on the Dedicated Properties are governed by operating agreement(s) under which Producer is a non-operator, Producer represents that it has been appointed as agent by the operator(s) and/or otherwise has the right to market and sell the Gas attributable thereto pursuant to the terms set forth in this Agreement. 10.2 Producer (or its predecessors in interest) and IACX (or its predecessors in interest) are parties to (i) that certain Percent of Proceeds Gas Purchase Agreement by and between Solis Partners, LLC and IACX Roswell LLC, dated as of September 1, 2020, Buyer contract number ROS20 001, (ii) that certain Percent of Proceeds Gas Purchase Agreement by and between Pecos River Operating, Inc. and Agave Energy Company dated August 1, 2013, Buyer contract number ROS13 021, (iii) Percent of Proceeds Gas Purchase Agreement by and between Scythian LTD and Agave Energy Company dated August 1, 2015, Buyer contract number ROS15 006, (iv) that certain Percent of Proceeds Gas Purchase Agreement by and between Manzano, LLC and Agave Energy Company dated August 1, 2013, Buyer contract number ROS13 015, and (v) that certain Percent of Proceeds Gas Purchase Agreement by and between Remnant Oil Operating, LLC and Agave Energy Company, Buyer contract number ROS16 003 (collectively, as amended, the “Legacy Contracts”). Upon the Effective Date, any obligations transferred to and/or between the Parties under the Legacy Contracts shall be terminated, and the relationship between the Parties concerning the relevant wells/leases covered thereby, and the sale and purchase of Gas therefrom, shall solely be governed by this Agreement. This termination does not include, and Producer expressly retains, the right to receive payments under the Legacy Contracts for pre-Effective Date Gas production for which payment is not yet due and for which IACX has not yet made payment in the ordinary course of business. - 10 - |

| ARTICLE 11 ENTIRE AGREEMENT 11.1 This Agreement, including its General Terms and Conditions and any attachments, exhibits, or appendices, is a complete record, supersedes any prior oral discussions or negotiations, and represents the entire understanding between the Parties relating to the purchase of Producer's Gas. No representations or agreements shall modify, change, amend or affect the obligations of the Parties under this Agreement, unless specifically agreed to in writing and signed by the authorized representatives of both Parties. 11.2 If this Agreement conflicts with the General Terms and Conditions attached to this Agreement, this Agreement shall govern. This Agreement is entered into by the authorized representatives of the Parties whose signatures appear below. IACX Roswell LLC Solis Partners, LLC By: By: Name: Jeremy Jordan Name: Title: Date: Manager 7/30/21 Title: Date: - 11 - |

| GENERAL TERMS AND CONDITIONS PERCENT OF PROCEEDS GAS PURCHASE AGREEMENT 1. Definitions 1.1 "Anchor Shipper" means a shipper that is given priority rights over other producers as set forth in Section 3.2. There does not have to be an Anchor Shipper for a system. 1.2 "BTU” means British thermal unit, and is the amount of heat required to raise the temperature of one pound of water one degree from 59 degrees to 60 degrees Fahrenheit. "MMBTU" means 1,000,000 BTUs. 1.3 "Bypass Gas" means Gas that could be Processed but under certain operating conditions is routed around the Processing Plant. 1.4 "Cubic foot" means the volume of gas that would occupy one cubic foot at a temperature of 60 degrees Fahrenheit and at a pressure of 14.73 psia. 1.5 "Day" means a period of 24 consecutive hours beginning at 8:00 a.m. Mountain Time, and "Daily" has the correlative meaning. 1.6 "Dedicated Properties" meansthe lands, leases and wells associated with the Receipt Points described on Exhibit A. 1.7 "Excess Gas" means Gas owned or controlled by Producer produced from the Dedicated Properties described in Exhibit A of this Agreement in excess of the FDC installed by IACX at or downstream from that Receipt Point(s). 1.8 "Facilities" means the Plant and associated pipelines, gathering system, dehydration, compression, amine unit or membrane system, communications, measurement, quality control, and overpressure facilities, in addition to any other facilities or system required for (a) delivery of gas to IACX, (b) receipt, purchase and Processing of Gas by IACX and/or (c) sale and delivery to downstream parties of Residue Gas, Plant Condensate and Plant Products by IACX. 1.9 “Facilities Design Capacity” or “FDC” means the Facilities capability in MCF per day. 1.10 "Field Condensate" means liquefiable hydrocarbons that have condensed from the Gas downstream of the Receipt Point and upstream of the Plant inlet meter. 1.11 "Force Majeure Event" means any act or event, whether foreseen or unforeseen, that meets all three of the following tests: (a) The act or event prevents a Party (the “Nonperforming Party”), in whole or in part from performing its obligations under this Agreement; (b) The act or event is beyond the reasonable control of and not the fault of the Nonperforming Party; and (c) The Nonperforming Party has been unable to avoid or overcome the act or event by the exercise of due diligence. Despite the preceding definition of a Force Majeure Event, a Force Majeure Event excludes economic hardship, changes in market conditions, and insufficiency of funds. 1.12 "Fuel" means the quantity of Gas actually used for fuel and includes actual lost and unaccounted for Gas ("LUG") as described herein. "Fuel" is the sum of Field Fuel, if any, and Plant Fuel, if any, as appropriate. (a) "Field Fuel" means all gas consumed upstream of the Plant including, but not limited to, gathering, compressing, dehydrating, or treating/blending, and Field LUG. |

| (b) "Plant Fuel" means all gas consumed between the inlet to the Plant and the Residue Gas, Plant Products and Plant Condensate sales point(s), including Plant LUG. 1.13 Lost and Unaccounted For Gas ("LUG") means: (a) “Field LUG” is Gas lost whether through meter variance, unmetered line loss, or line pack attributable to the field facilities between the Receipt Point(s) and the inlet to the Plant facilities. Field Condensate is specifically included in the Field LUG calculation. (b) “Plant LUG” is Gas lost whether through meter variance, unmetered loss, and Plant processes attributable to the Plant facilities between the inlet to the Plant facilities and the Residue Gas, Plant Products, and Plant Condensate sales point(s). 1.14 "Gas" or "gas" means any mixture of hydrocarbon gases and non-combustible gases, consisting predominantly of methane. No separate payment or value calculation to Producer is to be made under this Agreement for helium, sulfur, CO2, other non-hydrocarbons, or for Inferior Liquids (mixed crude oil, field condensate, slop oil, saltwater, and nuisance liquids). 1.15 "GPM" means gallons per MCF expressed on a real basis. 1.16 "Interruptible" means Producer's obligation to deliver and sell and/or IACX's obligation to receive and purchase gas under this Agreement may be suspended from time to time at such Party's sole election. 1.17 "MCF" means 1,000 cubic feet of gas at 14.73 psia at 60°F. "MMCF" means 1,000,000 cubic feet of gas. "BCF" means one billion cubic feet of gas. 1.18 "Month" means a calendarmonth consistent with the definition of the downstream pipeline or industry standard as adopted by IACX, and "Monthly" has the correlative meaning. 1.19 “NGL” or “NGLs” means natural gas liquids, and is a mixture of ethane, propane, iso-butane, normal butane and pentanes and heavier hydrocarbons contained in Gas. 1.20 "Off-Specification" means gas which does not meet the specifications described in Section 6.1. 1.21 “Plant” means collectively, and is used consistently throughout the Agreement with reference to, IACX’s “Bitter Lakes” gas Processing facility, IACX’s “Red Bluff” gas Processing facility, IACX’s “Wright” gas treating plant, and IACX’s “Pathfinder” gas treating plant, all located in Chaves County, New Mexico. 1.22 "Plant Condensate" means stabilized liquid hydrocarbons recovered fromthe Gas during the Processing phase in the Plant. 1.23 "Plant Products" means NGLs and any incidental methane separated from the Gas after Processing. 1.24 "Primary Term" is defined on page 1 of the Agreement (under the heading TERM). 1.25 "psig" means pounds per square inch gauge. “psia” means pounds per square inch absolute. 1.26 "Process” or “Processing" includes any or all of the following: (a) separating Plant Products from gas (sometimes called "processing"), (b) altering the gas constituents to meet quality specifications (sometimes called "conditioning"), (c) removing inerts/contaminants in the gas (sometimes called "treating"). (d) Processing may also include blending, comingling, or diluting Producer's Gas |

| with other gas or otherwise altering Producer's Gas to meet the quality specifications of any downstream pipeline. 1.27 "Producer's Gas" means all Gas owned or controlled by Producer now or hereafter produced from the Dedicated Properties or any lands pooled, unitized or communitized therewith. 1.28 "Receipt Point" shall mean the point of sale and interconnection between the facilities of Producer and IACX's Facilities as identified in Exhibit A. 1.29 "Residue Gas" means merchantable hydrocarbon gas available for sale from IACX's Facilities after Processing and may include some volume of Bypass Gas depending upon operating conditions. 1.30 "Year" means a period of 365 Days; provided, however, that any such year which contains a date of February 29 shall consist of 366 Days. 1.31 Any undefined terms shall have standard industry meaning. Other terms used in this Agreement may be defined in other parts of this Agreement. 2. [Intentionally Omitted]. 3. Curtailment Schedule 3.1 Limitations on IACX's Take Obligations. IACX will diligently operate or cause operation of its Facilities in an effort to maintain consistent takes of all available quantities of Producer's Gas. The amount of gas which IACX will purchase and receive hereunder will vary from time to time and will depend upon operating conditions of IACX's Facilities, the FDC installed by IACX at, or downstream from, that Receipt Point(s)and the requirements of IACX's customers. 3.2 Ratable Takes. For any period during which the quantity of gas available for delivery to the Receipt Points exceeds the capacity of IACX's Facilities for any reason, including, without limitation, Force Majeure, maintenance, or operational considerations ("Curtailment''), IACX shall have the right to interrupt or curtail receipts of gas to meet the Force Majeure, maintenance, or operational requirements. If a Curtailment is instituted, IACX shall endeavor to do so in the following order: (a) First, all Interruptible receipts shall be curtailed in their entirety (prior to curtailing any other Receipts) ratably by GPM content; (b) Second, IACX shall curtail in its entirety (prior to curtailing any other Receipts) gas produced from wells with "wellbore only" dedication with no associated acreage ratably by GPM content; (c) Third, IACX shall curtail in its entirety (prior to curtailing any other Receipts) gas from wells associated with dedicated acreage and/or volume commitments to IACX ratably by GPM content; (d) Fourth, IACX shall curtail receipts from Anchor Shipper(s) ratably by GPM content; (e) To the extent the circumstances necessitating Curtailment do not allow IACX to follow the above curtailment schedule, IACX may, in good faith, implement such other measures as are reasonable and appropriate. The Parties are aware of 19.15.24 NMAC regarding Ratable Takes and agree that, to the extent the rules are deemed applicable to the foregoing curtailment of volumes under this Agreement, the Curtailment schedule is reasonable and reflects a fair relationship between different quality, quantity, and pressure of gas available and to the relative lengths of time during which the gas will be available to IACX. 4. Pressure |

| 4.1 Producer shall install, own, operate, and maintain pressure relief and/or other shut off devices upstream of the Receipt Point(s) to prevent delivery of gas to IACX in excess of the MAOP of 1,000 psig. Such pressure relief and/or other shut off devices shall be installed no closer than fifty (50) feet to IACX's equipment. If overpressure or damage occurs to IACX's system due to pulsation or over-temperature conditions caused by Producer's installed equipment, IACX shall; (a) notify Producer; (b) identify damage and/or losses; (c) provide an estimate of repair costs; and (d) may deduct from the proceeds otherwise payable to the Producer a fee to cover the actual and reasonable costs incurred from lost gas or physical damage to IACX's Facilities. If the amounts recovered from the consideration due Producer under Article 5 for two consecutive monthly settlement periods do not cover the loss or damages IACX shall then send Producer an invoice for the balance remaining and the Producer shall pay such invoice within thirty (30) Days of receipt. 4.2 All Gas delivered hereunder by the Producer at the Receipt Point(s) shall be at pressures sufficient to enable such gas to enter IACX's Facilities at the Receipt Point(s). IACX shall have no obligation to provide additional compression or otherwise change its normal operations to accept said deliveries of Producer's Gas. 4.3 Producer may, at its sole cost and expense, provide compression upstream of the Receipt Point(s). Producer shall install, own, operate, and maintain the following protection equipment with any compression installed, owned or operated by Producer: (a) overpressure relief and/or shut-off devices to prevent Gas pressure from exceeding IACX's MAOP of 1,000 psig; (b) gas cooling to prevent Gas temperatures from exceeding 120 degrees Fahrenheit; and (c) necessary pulsation dampening equipment to minimize pulsation induced measurement errors causing meter inaccuracies greater than one-quarter of one percent (0.25%). 5. Scheduling of Gas Receipts 5.1 Scheduling. IACX and Producer agree that scheduling and commencement of service hereunder will be consistent with and subject to downstream pipeline requirements; however, Producer is not required to submit Receipt Point nominations to IACX. (a) If Producer connects any new well(s) or disconnects any existing well(s) behind or upstream of existing Receipt Points, Producer will provide to IACX a list of said well(s) and the estimated change in volumes or daily flow rates attributable to the (dis)connection(s) within 30 Days of doing so. (b) In addition, IACX may, from time to time, request information from Producer concerning projected daily flow rates to the Receipt Point(s). 5.2 Operating Requirements. Producer shall use reasonable efforts to deliver gas at uniform hourly and Daily rates of flow. 6. Quality and Fees 6.1 The Gas received from Producer at each Receipt Point shall comply with the quality requirements set forth herein. The Gas received at each Receipt Point shall be commercially free of hydrocarbons and water in the liquid state, brine, air, dust, gums, gum-forming constituents, bacteria, and other objectionable liquids and solids. (a) The Gas received at each Receipt Point shall meet the following quality specifications: |

| (i) no greater than 4 parts permillion by volume of hydrogen sulfide (H2S); (ii) no greater than 0.75 grains of total sulfur per 100 cubic feet of gas (iii) no greater than 0.3 grains of mercaptan per 100 cubic feet of gas; (iv) no greater than two (2.00) mole percent of carbon dioxide (CO2); (v) no greater than a combined total of ten (10.00) mole percent of nitrogen, CO2, oxygen, helium and other diluents (collectively, “Total Inerts”); provided, however, that in any Month in which the weighted-average mole percent of the Total Inerts in all Gas delivered by Producer to all Receipt Points is no greater than seven (7.00) mole percent, IACX agrees it will not exercise its right to reject Gas from any Receipt Point solely on the basis of the quality specification set forth in this Section 6.1(a)(v); (vi) no greater than 0.10% mole percent of oxygen, and the Gas shall not have been subjected to any treatment or process that permits or causes the admission of oxygen, that dilutes the gas, or otherwise causes it to fail to meet these quality specifications; (vii) 5 micrograms per cubic meter of trimethylarsine or any other trialkylarsine component; and (viii) no greater than 120 degrees Fahrenheit at the Receipt Point(s) and (b) have a total heating value of not less than 1000 BTUs per cubic foot. (b) Should any downstream pipeline require strict compliance with the downstream pipeline’s existing quality specifications, or should the downstream pipeline implement additional or more stringent quality specifications in either case after the Effective Date of this Agreement and which are more stringent than those stated above such that Gas supplied hereunder does not meet such requirement, other than as to water vapor and hydrocarbon dew point specifications, then the parties shall cooperate to meet the new requirements in the most efficient manner, and in the event IACX incurs additional costs related thereto, it shall be entitled to invoice Producer for such costs, and Producer shall pay such invoice within thirty (30) Days of receipt. To the extent such costs are to be shared with other similarly situated producers on the IACX system, IACX shall charge Producer only its reasonably allocated portion of such costs. (c) Producer’s Gas shall not contain any substances in such amounts as, after treating, blending, conditioning, and Processing inIACX's facilities, would cause Y-grade attributable to such Gas to fail to meet the most stringent downstream pipeline Y-Gradespecifications. 6.2 Producer shall notify IACX in writing of any gas that Producer desires to tender to IACX which does not conform to the quality specifications in Section 6.1 describing in sufficient detail the quality specifications for the Off-Specification gas. Following receipt of such written notification, IACX may, in its sole discretion, elect not to accept and receive such gas without any penalty whatsoever to IACX. IACX shall respond to Producer’s such written notice within 15 Days of receipt, indicating whether IACX will accept or reject such Off-Specification gas. Without limiting the foregoing in any way, if the gas tendered by Producer fails at any time to conform to the specifications in this Section, IACX may, at its option, notify Producer and refuse to accept such gas, and IACX, at Producer’s request, shall release said Gas from dedication hereunder. Notwithstanding anything herein to the contrary, except with respect to Off-specification gas that IACX has elected to accept and receive, Producer shall indemnify IACX and hold it harmless from all suits, actions, regulatory proceedings, damages, costs, replacement of line pack, losses and expenses (including any lost profits resulting from downtime and reasonable attorney fees) arising out of the failure of the gas tendered by Producer to conform to the quality specifications, including any injury or damage done to IACX's Facilities or the line pack. 6.3 Acceptance of gas that does not conform to the specifications in Section 6.1 does |

| not constitute any waiver of IACX's right to refuse to accept any other non-conforming gas. 6.4 IACX may deduct from the proceeds otherwise payable hereunder a fee to cover the actual and reasonable costs incurred from lost gas or physical damage to IACX's Facilities resulting from Off-Specification gas delivered by Producer unless IACX agreed in writing to accept and receive such Off-Specification gas. If the deduction is not sufficient to cover such loss or damages, then IACX shall send Producer an invoice of the actual costs of lost gas and damages to IACX's Facilities caused by Producer's delivery of Off-Specification gas to IACX's Facilities. Producer shall pay such invoice within thirty (30) Days of receipt. 6.5 For any gas that does not meet the specifications in Section 6.1, Producer will pay IACX the following fees: (a) If Producer delivers gas exceeding 2.00 mole percent CO2 that is not rejected by IACX under Section 6.2, IACX will deduct from the proceeds otherwise payable the CO2 treating/blending rate of $0.05/MCF plus an additional $0.02/MCF for each mole percent, and each fraction of a mole percent, of CO2 content over 2.00 mole percent for all volumes delivered by Producer at the affected Receipt Point(s). (b) if Producer delivers gas containing more than 4 ppm of hydrogen sulfide (H2S) IACX may, in addition to other remedies in this Agreement, refuse to accept such gas or may charge a mutually agreeable fee to treat such gas prior to delivery to IACX. (c) if, in a given Month, Producer delivers gas containing more than the lower of: (i) ten (10.00) mole percent of Total Inerts; or (ii) the more stringent quality specification required or implemented by any downstream pipeline with respect to Total Inerts, as contemplated by Section 6.1(i), IACX may, in addition to other remedies in this Agreement, refuse to accept such gas or may charge a mutually agreeable fee to treat such gas prior to delivery to IACX at the affected Receipt Point(s). (d) All fees set forth in this Section 6.5 for treating/blending or other services are stated and are to be applied on an Mcf basis at the Receipt Point. (e) The then effective rates for services described above and provided hereunder by IACX or its designee may be increased by IACX each July 1, beginning July 1, 2022, by the mechanism set forth in FERC Regulation 18 C.F.R.§ 342.3 or any successor thereto; provided that if the indexing policy would decrease the then current rates, it shall not apply and said rates shall not be decreased, and further provided that any annual increase shall be limited to 2.00%. The application of this mechanism shall never cause the rates to be less than the initial rates. 6.6 Nothing in this Section obligates IACX to Process Producer's gas above the FDC. 6.7 Producer agrees to install and maintain at its sole cost and expense, mechanical separation equipment upstream of the Receipt Point(s) to prevent free liquids from entering IACX's Facilities. Notwithstanding Section 6.1 regarding the quality of Producer's gas, Producer shall not Process nor allow another to Process the gas for recovery of liquefiable hydrocarbons or helium prior to the receipt of Producer's gas by IACX, other than by the use of conventional mechanical liquid-gas separators operated at or above ambient temperatures. Unless otherwise agreed to in writing, IACX shall have the right to retain ownership to all Field Condensate. 7. Measurement 7.1 Use of Measurement. For settlement, billing, balancing, and calculation of fuel use, gas volumes will be determined according to this Section. 7.2 Unit of Measurement and Metering Base. The unit of volume shall be one cubic foot of gas at a pressure base of 14.73 pounds per square inch absolute, at a temperature |

| base of 60 degrees Fahrenheit. Computation of volumes will follow industry accepted practices. 7.3 Atmospheric Pressure. For the purpose of volume determination and meter calibration, IACX may elect to measure and use the actual atmospheric (barometric) pressure or may assume a constant atmospheric pressure of 13.2 psia. 7.4 Temperature. For the purpose of volume determination and meter calibration, IACX may elect to measure the actual temperature of the gas at the point of measurement using an industry accepted recording thermometer or electronic device. In the absence of actual temperature measurement, IACX may elect to use an assumed constant temperature of 60 degrees Fahrenheit. 7.5 Determination of Gas Composition, Gross Heating Value, and Specific Gravity. (a) Gas Composition. IACX shall obtain a representative sample of Producer's gas delivered at each Receipt Point for determining the gas composition used to compute gas volumes. IACX may elect to use continuous samplers instead of spot samples. Upon IACX's written request, Producer shall provide to IACX a copy of the most recent chromatographic gas analysis for any of Producer's wells connected to Producer's system upstream of any Receipt Point on IACX's system that is a central delivery point. If the most recent gas analysis provided by Producer is more than three months old, then Producer shall permit IACX, at IACX’s cost and expense, to obtain a gas sample from the well(s) upstream of the central delivery point and Producer agrees to assist IACX in obtaining said sample. Gas composition of the sample (including mole percentages, GPM and heating value) will be determined using chromatographic analysis or other industry accepted method. IACX shall obtain such samples on the following schedule or more often as the IACX deems reasonable. New gas compositions shall be applied to volume calculations as soon as reasonably possible or on the first of the month following the test and will continue to be in effect until a new sample is obtained and its composition is available. Gas Sampling Schedule MCFD Analysis greater than 2,500 MCFD Quarterly 250 to 2,500 MCFD Semi Annual less than 250 MCFD Annual (b) Gross Heating Value and Specific Gravity. The determination of gross heating value and specific gravity will be made from the composition by calculation using physical gas constants for gas compounds as outlined in GPA Standard 2145-16 and GPA Standard 2172-16 (Table of Physical Constants of paraffin Hydrocarbons and Other Components of Natural Gas) with any subsequent amendments or revisions that IACX may elect to adopt. The calculations for volume and energy (MCF and MMBTU) will assume the gas to be dry if the gas at the Receipt Points contains less than seven (7) pounds of water per MMCF. If the gas at the Receipt points contains seven (7) pounds or more of water per MMCF, the gas is assumed to be saturated with water at delivery temperature and pressure. Volume and energy calculations for wet gas shall use the procedure established in GPA Standard 2172-16 for determining the MCF and Gross Heating Value of the gas. 7.6 Compressibility. The measurement of gas will be corrected for deviation from Boyle's Law at the pressures and temperatures under which gas is measured by use of the calculation appearing in the American Gas Association Committee Report #8. At IACX's discretion, amendments to American Gas Association Committee Report #8 may be adopted and implemented. Composition of the metered gas stream used in the compressibility calculations shall be determined as described in Section 7.5(a). |

| 7.7 Measuring Equipment. IACX will install, own, operate and maintain measuring stations at the Receipt Points through which the quantities of Gas delivered hereunder will be measured. The records from the measuring equipment shall remain the property of the party owning the equipment, but within thirty (30) days of a written request, each party will make available during normal working hours a time and place for the other party to inspect its records and charts, together with related calculations. Producer shall supply measurement data from Producer's check measurement to IACX within thirty (30) days of a written request from IACX. 7.8 Metering. IACX shall install orifice or turbine meters at the Receipt Points. (a) Orifice Meters. All orifice meters will be installed and gas volumes computed according to industry accepted standards prescribed in ANSI/API 2530 (Orifice Metering of Natural Gas). (b) Turbine Meters. All turbine meters will be installed and gas volumes computed in accordance with the industry accepted standards prescribed in Transmission Measurement Committee Report No. 7 (Measurement of Fuel Gas by Turbine Meters). (c) IACX may adopt the most recent edition of standard ANSI /API 2530 and the Transmission Measurement Committee Report No. 7. 7.9 Electronic Flow Computers. IACX, at its sole option, may install electronic flow computers to determine gas flows without the use of charts. 7.10 New Measurement Techniques. If a new method or technique is developed and accepted by the industry for gas measurement or the determination of the factors used in the gas measurement, the new method or technique may be adopted or substituted by IACX. 7.11 Calibration and Test ofMeters. The accuracy of all measuring equipment will be verified by IACX at no less frequent intervals than specified in the table below. If requested in writing by Producer, reasonable advance notice of the time of all testsand calibrations of meters and of sampling for determinations of gross heating value and qualityshall be provided to the Producer so that it may have its representatives present to witness tests and sampling or to make joint tests and obtain samples with its own equipment. MCFD Calibration greater than 2,500 MCFD Monthly 250 to 2,500 MCFD Quarterly 30 to 249 MCFD Semi-Annual less than 30 MCFD Annual If either Party desires a special test of any measuring equipment, it will promptly notify the other, and the Parties shall then cooperate to secure a prompt verification of the accuracy of the equipment. The Party requesting the special test shall bear all costs. 7.12 Correction of Metering Errors. If any measuring equipment is found to be inaccurate, the equipment will be adjusted immediately to measure accurately. If the measuring equipment in the aggregate is found to be inaccurate by two percent (2%) or more by volume at a recording corresponding to the average hourly rate of gas flow for the period since the last preceding test, the measuring party will correct previous readings to zero error for any known or agreed-upon period. Any payments based upon inaccurate measurement will be corrected at the rate of the inaccuracy for any period that is known definitely or agreed upon. However, when the period in question cannot be defined or agreed upon by all parties, the correction period shall be one half of the time elapsed since the date of the last test, not toexceed ninety (90) days. Any corrections shall bemade upon the first of the following methods that is feasible: |

| (a) By correcting the error if the percentage of error is ascertainable by calibration, special test, or mathematical calculation, or, in the absence of (a); (b) By using the registration of any check meter or meters, if installed and accurately registering, or, in the absence of (a) and (b); (c) By estimating the quantity of gas received or delivered based on receipts or deliveries during preceding periods under similar conditions when the measuring equipment was registering accurately. 7.13 Preservation of Records. Producer and IACX shall preserve original and edited test data, charts, volumetric data, gas quality data, calibrations, equipment changes or other similar records for a period of at least three years, or for such longer period as may be required by appropriate regulatory authority. 7.14 Claims. All claims of any Party as to the quantity of gas metered and delivered, or any other matter related to measurement under this Section, must be submitted in writing by the Party within ninety (90) Days from the earlier of the date of commencement of the claimed discrepancy or date of inspection giving rise to such claim. 7.15 Check meters. Either Party may, at its option and expense, install and operate check-measuring equipment, provided that the equipment is installed in a way that does not interfere with the operations of the other Party. Either Party's check meters shall be subject at all reasonable times to inspection and examination by a representative of the other Party, but the reading, calibration, adjustment, or changing of charts shall be done only by the Party installing the check meters. The measurement equipment of Producer shall be for check purposes only and, except as expressly provided in this Agreement, shall not be used for billing or balancing purposes under the Agreement. 8. Billing and Payment 8.1 On or before the last day of each calendar Month, IACX shall issue to Producer statements showing the total volume and BTU content of the gas received at the Receipt Point(s) from Producer for the preceding calendar Month. IACX will make payment to Producer on or before the last day of the Month for all gas delivered by Producer to IACX during the preceding Month. The statements shall show quantities of Residue Gas, Plant Condensate and Plant Products allocated to Producer, Realization Prices for Residue Gas, Plant Condensate and Plant Products and amounts due IACX from Producer for fees or other charges. IACX's payment to Producer will be the net amount due Producer after deducting amounts owed to IACX by Producer. 8.2 Upon 10 Days written notice, each Party shall have the right to examine the books and records of the other Party relating to the service provided during normal business hours for the purpose of determining or confirming all billings and payments. 9. Government Requirements If this Agreement or the services provided hereunder become subject to the jurisdiction of the FERC, or any other governmental authorities to which it is not already subject on the Effective Date of the Agreement, and IACX is adversely affected by the change in or addition to jurisdiction, IACX may terminate this Agreement upon the effective date of the jurisdiction. Written notice of the pending termination must be given prior to the termination date. If, after the Effective Date of this Agreement, any governmental authority with jurisdiction to regulate this Agreement, the services provided hereunder, or any aspect of IACX's operations passes a law, regulation, or rule affecting IACX's operations that IACX is unwilling, in its sole discretion, to follow, IACX may terminate this Agreement with no liability to Producer. Producer does not have the right to require IACX to comply with such law, regulation, or rule. |

| 10. Indemnification and Warranty 10.1 Producer’s Liability and Indemnification. Producer shall retain title to and possession of Producer's gas until delivered to IACX at the Receipt Point(s) and shall be fully responsible and liable for any and all damages, claims, actions, expenses, penalties and liabilities, including attorney's fees, arising from personal injury, death, property damage, environmental damage, pollution, or contamination relating to Producer's gas while in Producer's control and possession, and Producer agrees to release, indemnify and defend IACX with respect thereto. Producer further agrees to release, indemnify and defend IACX from and against any and all damages, claims, actions, expenses, penalties and liabilities, including attorney's fees, arising from personal injury, death, property damage, environmental damage, pollution, or contamination relating to Producer's ownership and/or operation of any facilities delivering gas to the Receipt Point(s). 10.2 IACX's Liability and Indemnification. IACX shall take title to and control the gas upon its delivery to IACX at the Receipt Point(s) and shall be fully responsible and liable for any and all damages, claims, action, expenses, penalties and liabilities, including attorneys' fees, arising from personal injury, death, property damage, environmental damage, pollution or contamination relating to the gas while in IACX's control and possession, and IACX agrees to release, indemnify and defend Producer with respect thereto. However, if, without IACX's prior knowledge, Producer has delivered Off-Specification gas, then Producer shall be responsible for, and shall reimburse IACX for all actual expenses, damages and costs resulting therefrom, provided that IACX has, upon gaining knowledge of the existence of such contaminants, provided notice as soon as possible to Producer and terminated further receipts of the Off-Specification gas as soon as practicable. If IACX, at its sole discretion, elects to accept the Off-Specification gas, then IACX shall be responsible for, and Producer shall be relieved of any liability to IACX subsequent to the date upon which IACX agreed to accept the Off-Specification gas (but only as to the specific volumes and chemical composition agreed to by IACX), for damages to IACX's Facilities arising from Off-Specification gas. IACX further agrees to release, indemnify and defend Producer from and against any and all damages, claims, actions, expenses, penalties and liabilities, including attorneys' fees, arising from personal injury, death, property damage, environmental damage, pollution or contamination relating to IACX's ownership and/or operation of the Facilities and/or IACX's performance or nonperformance of its obligations under this Agreement. 10.3 IN NO EVENT WILL IACX BE LIABLE FOR ANY LOST PROFITS, LOSS OF BUSINESS, SPECIAL, INCIDENTAL OR CONSEQUENTIAL DAMAGES OF ANY NATURE ARISING OUT OF ANY BREACH OF ITS OBLIGATIONS OR PERFORMANCES UNDER THIS AGREEMENT. 10.4 Warranty. Producer represents and warrants that it has good and clear title to or the right to deliver, Process, and sell the gasdedicated under this Agreement and further warrants that the gas is free and clear of all liens,encumbrances and adverse claims whatsoever, including tax liens. Producer agrees to indemnify IACX and save it harmless from all suits, actions, claims, debts, accounts, damages, costs (including attorney's fees), losses, liens, license fees, and expenses that arise from Producer's obligations under this Section. Producer represents and warrants to IACX that all Gas delivered by Producer, or for its account, to IACX hereunder (i) was produced in the state of New Mexico, (ii) has not been sold, consumed, transported or otherwise utilized in interstate commerce at any point upstream of the Receipt Points hereunder, and (iii) has not been commingled at any point upstream of the Receipt Points hereunder with other Gas which has been sold, consumed, transported or otherwise utilized in interstate commerce in such a manner which will or would subject the Gas hereunder or IACX's or its designee's facilities, or any portion thereof, to the jurisdiction of the Federal Energy Regulatory Commission or any successor |

| authority under the Natural Gas Act of 1938. Further, Producer agrees that it will give IACX at least thirty (30) Days written notice prior to Producer delivering any Gas hereunder which does not conform to the representations and warranties expressed in this Paragraph 10.4. This Agreement shall terminate without liability to Producer unless IACX provides its written consent to accept such Gas under this Agreement or another agreement. Producer agrees to indemnify and hold IACX harmless from and against any and allsuits, actions, damages, costs, losses and expenses (including reasonable attorney fees) sustained by IACX, as well as any regulatory proceedings, arising out of or in connection withany breach by Producer of the representation and warranties expressed in this Paragraph 10.4. If Producer breaches any of the representations andwarranties expressed in this Paragraph 10.4, thenIACX has the right to terminate this Agreement immediately without liability, by IACX, to Producer. Such right shall be in addition to any other remedy IACX may have pursuant to the provisions hereof, or at law or in equity. 10.5 In the event Producer's title or right to Process or sell Producer's Gas is questioned by any person or entity, including IACX, IACX shall have the right to withhold, in whole or in part, the consideration due Producer under Article 5, without liability for interest, from the time the question is brought to IACX's attention until Producer's right or title is freed from such question, including during the period of time any action or claim regarding same is pending, until the title information described in Section 10.6 is received, or until Producer supplies IACX with a bond acceptable to IACX that will save IACX harmless from any claims that may arise from IACX having made payment of any amounts to Producer to which Producer was not entitled or for Producer's Gas in which Producer did not have good and clear title and/or the right to Process or sell hereunder. 10.6 If Producer's title or right to receive any payment is questioned or involved in litigation, then, in addition to the right to withhold consideration due Producer under Section 10.5, IACX shall have the right to demand, and Producer shall furnish to IACX, assurance of title and/or the right to Process or sell Producer's Gas hereunder in a form acceptable to IACX, including: (a) abstracts of title to the Dedicated Properties; (b) copies of the oil and gas leases covering the Dedicated Properties and certified copies of any assignments of any interests therein; (c) a certification of Producer's interest covered hereunder including the names of all other working interest owners and the gross working interest owned by Producer and each of the other working interest owners whose interests are included in this Agreement; (d) division order title opinions, and executed division and/or transfer orders; (e) and such other documents as may be necessary or desirable to satisfy IACX that Producer has good and clear title or right to Process or sell Producer's Gas and/or the right to dedicate and commit same hereunder. 11. Royalties, Taxes, Fees and Other Charges. 11.1 Royalties. Producer shall be responsible and liable for the payment of all royalties relating to Producer's gas. IACX shall have no responsibility or liability for such royalties and Producer shall release, indemnify and defend IACX against any and all damages, claims, actions, expenses, penalties and liabilities, including attorney's fees, relating to such royalties. 11.2 Taxes, Fees and Other Charges. Producer shall be responsible and liable for all taxes (excepting those assessed on the income and property of IACX), fees and other charges (including penalties and interest thereon) now or hereafter levied or assessed by any municipal, county, state, federal or tribal government relating to Producer's Gas, including those assessments, taxes, and costs of complying with any environmental laws, including those which regulate carbon dioxide. If IACX is required to pay or bear any such taxes, fees, costs, or other charges (or penalties or interest thereon), Producer shall reimburse IACX, and Producer shall release, indemnify and defend IACX against any and all damages, claims, actions, expenses, penalties and liabilities, including attorney's fees, relating to such taxes, fees or other charges. |

| 11.3 IACX shall have the right to invoice Producer for the additional costs or expenses IACX may incur in connection with construction or operation of the Facilities or with providing the services under this Agreement in each case in order to comply with changes after the Effective Date in applicable U.S. federal, state, and local laws, rules, regulations, permits, approvals, and requirements pertaining to health, safety, or the environment, including without limitation, any laws, rules and regulations pertaining to greenhouse gases and carbon dioxide (the "Environmental Laws") or changes after the Effective Date in the interpretation of Environmental Laws. Such costs and expenses may include but are not limited to direct, actual, or pro rata costs or expenses incurred by IACX in order for IACX to provide Producer the services hereunder relating to (a) making additions or modifications to Facilities; (b) changing methods of operation to comply with new or revised laws or regulations (or interpretations thereof); (c) implementing the conditions of any permit necessary to operate; (d) preventing, reducing, controlling or monitoring any emission, exposure, or discharge into the environment, or (e) paying additional fees, taxes (but excluding income tax and property tax), or assessments or purchasing emission credits, allowances, or offsets that may be necessary under the Environmental Laws ("Compliance Costs"). If IACX is required to expend Compliance Costs to perform in any way under this Agreement, IACX may from time to time provide Producer with an invoice as to the Compliance Costs incurred during the relevant period, To the extent such costs are to be shared with other similarly situated producers on the IACX system, IACX shall charge Producer only its reasonably allocated portion of such costs. Producer shall reimburse IACX for any amounts it expends on Compliance Costs within 30 days of receiving notice of such costs. 11.4 Limitation on Tax Responsibility. Neither Party shall be responsible or liable for the taxes now or hereafter levied or assessed by any municipal, county, state, federal or tribal government upon the income, property or facilities of the other. 12. Force Majeure 12.1 If either Party is rendered wholly or partially unable to carry out its obligations under this Agreement due to a Force Majeure Event, the Party shall give written notice describing the Force Majeure Event as soon as is reasonably possible after the occurrence. The obligations of the Parties, other than to make payments of amounts due, in so far as they are affected by such Force Majeure Event, shall be suspended during the continuance of the Force Majeure Event, but for no longer period. The affected Party shall remedy the Force Majeure Event in a commercially reasonable manner and exercise reasonable diligence to correct such Force Majeure. Nothing in this Agreement shall be construed to require either Party to settle a strike or labor dispute against its better judgment. 13. Fuel Gas 13.1 Producer shall provide to or reimburse IACX for all Fuel used or allocated to Producer's Gas in performing the services contemplated by this Agreement. 13.2 Intentionally left blank. 13.3 At IACX's option, IACX may provide Producer written notice of the Fuel percentages that will be in effect for a defined time period determined by IACX, provided that such time period shall be between a quarter Year and one Year. These Fuel percentages shall be based on IACX's actual usage during the previous Year or a reasonable determination if actual usage is not known at such time, and which may be adjusted by IACX when necessary to improve accuracy. Producer shall be charged these Fuel percentages for the defined time period. At the conclusion of each defined time period, IACX shall compare the actual Fuel percentages with those percentages charged to Producer (i.e. true-up). IACX shall provide Producer with the results of such true-up within one (1) Month of the conclusion of the defined time period. Thereafter, if either Party owes any monies due to this true-up to the other Party, the owing Party shall promptly pay such amounts to the other Party or |

| IACX may deduct or add, as appropriate, any of such amounts to those amounts owed by Producer to IACX in the future under this Agreement. 13.4 In the event IACX utilizes electric power in lieu of gas for operation of any compression in IACX's Facilities, as now existing or as hereafter expanded or improved, such electrical expenses will be allocated to Producer by multiplying the total electrical power cost for all compression equipment servicing Producer's Gas by a factor. The numerator of such fraction will be the volume (MCF) of Producer's Gas delivered under this Agreement using such electrically powered compression equipment and the denominator will be the total volume (MCF) of Gas using such electrically powered compression equipment. Producer's allocated electrical cost will then be invoiced to, and paid by or collected from, Producer, in accordance with the terms and conditions of this Agreement. 14. Creditworthiness 14.1 If Producer is in arrears in its payments, or is otherwise in breach of this Agreement, upon ten (10) Days advance written notice IACX may suspend services under this Agreement unless payment is forthcoming within the notice period. If Producer remains in default after notice to pay or otherwise perform as to any fee or imbalance, or if IACX is insecure of Producer's performance, without prejudice to any other remedies IACX may (i) refuse to receive or deliver gas, (ii) suspend performance pending adequate assurance of payments, (iii) demand an irrevocable letter of credit, surety bond, or other reasonable security for payment, (iv) require advance payment in cash or payment on a more frequent billing cycle than Monthly, (v) collect any amounts due from Producer to IACX or its affiliates for any reason at any time under this or other transactions by deducting them from any proceeds payable to Producer or affiliates of Producer, or (vi) take other action as IACX deems reasonable under the circumstances to protect its interests. 14.2 IACX may also require Producer at any time to supply IACX credit information, including but not limited to bank references, and names of persons with whom IACX may make reasonable inquiry into Producer's creditworthiness and obtain adequate assurance of Producer's solvency and ability to perform. 14.3 Producer hereby grants IACX a security interest in gas owned or controlled by Producer in IACX's possession to secure payment of all fees and other amounts due under this Agreement, and following a Producer default, IACX may foreclose this possessory security interest in any reasonable manner. Upon request Producer shall execute a UCC-1 or similar Financing Statement suitable for recording describing this security interest and lien. 14.4 If Producer in good faithdisputes the amount of any billing, Producer shall nevertheless pay to IACX the amounts it concedes to be correct and provide IACX an explanation and documentation supporting Producer's position regarding the disputed billing. IACX shall then continue service for a reasonable time pending resolution of the dispute. 15. Installation of Facilities Except as specifically set forth in this Agreement, IACX shall not be required to install or construct any additional facilities in order to purchase Producer's gas. Unless otherwise agreed in writing, IACX shall only be responsible for the maintenance and operation of its own properties and Facilities and shall not be responsible for the maintenance or operation of any other properties or facilities connected in any way with the purchase of Gas or the providing of servicesunder this Agreement. 16. Access, Easements and Rights-of-way Insofar as Producer's lease or leases permit and insofar as Producer or its lease operator may have any rights however derived (whether from an oil and gas lease, easement, governmental agency order, regulation, statute, or otherwise), Producer shall provide IACX access to its facilities and grants to IACX the use of all easements and rights-of-way held by or available |

| to Producer that are necessary and convenient for IACX to perform its obligations to Producer (but not to parties other than Producer) under this Agreement. Such use shall include, but not be limited to, those rights under Producer's oil and gas lease(s) to construct, operate, and maintain pipelines and appurtenant facilities for the purpose of IACX performing under this Agreement. Producer shall be responsible for maintaining such access, easements and rights-of-way at its sole cost and expense. IACX shall be responsible for its own pipeline rights-of-way rentals. 17. Effects of Termination If this Agreement is terminated for any reason IACX has the right to disconnect its system from the Receipt Point(s). 18. Miscellaneous 18.1 Waiver. A waiver by either Party of any one or more defaults by the other Party shall not operate as a waiver of any future default(s), whether of a like or different character. Failure or delay in enforcing a right is not a waiver of that right. 18.2 Recitals. In interpreting this Agreement, the recitals shall be considered as part of this Agreement and not as surplusage. 18.3 Confidentiality. The Parties and their respective officers, directors, employees, agents and representatives shall keep the terms of this Agreement confidential. However, either Party may disclose the terms of this Agreement to the following persons or entities in the following circumstances: (a) To financial institutions requiring such disclosure as a condition precedent to making or renewing a loan or independent certified public accountants for purposes of obtaining a financial audit; provided, however, that such financial institutions or accountants have agreed in writing to keep the terms of this Agreement confidential. (b) In conjunction with the sale or transfer of either Parties' Facilities subject to or related to the obligations under this Agreement; provided, however, that any such potential buyer or transferee has agreed in writing to keep the terms of this Agreement confidential. (c) To courts or other governmental authorities, including persons or entities to whom disclosure is required by such courts or other governmental authority if such disclosure is required by law, regulation, rule or order; provided, however, that the Party making such disclosure shall use its best efforts to obtain a protective order or other reliable assurance that confidential treatment will be accorded the terms to this Agreement. 18.4 Governing Law. All matters arising out of or relating to this Agreement and the transactions it contemplates shall be construed, interpreted and governed by the laws of the state of New Mexico without regard to choice of law principles thereof. For all matters arising out of or relating to this Agreement and the transactions it contemplates, the Parties consent to the exclusive jurisdiction and venue in any court of competent jurisdiction within the county(ies) where the Dedicated Properties are located and the applicable U.S. District Court, and to service of process under the statutes of New Mexico. 18.5 No Third Party Beneficiaries. It is the intent of the Parties that no person or entity besides IACX, Producer and their respective successors and permitted assigns shall be entitled to enforce any provision of this Agreement and that the covenants and obligations set forth in this Agreement are solely for the benefit of IACX, Producer and their respective successors and permitted assigns. 18.6 Transfer of Interest in Gas. Any dedication of Producer's Gas under this Agreement shall run with the leases and lands from which the gas is produced. Any transfer of Producer's right, title, or interest in the Gas dedicated to IACX under this Agreement through sale, farm-out, trade, or any other similar agreement, shall not impair its dedication to |

| IACX. Producer shall notify any transferee in writing that such gas remains dedicated to IACX pursuant to this Agreement. Producer shall also notify IACX of any such transfer within fifteen (15) Days of the effective date of the transfer. Failure of Producer to send written notice to transferee of the dedication or to so notify IACX of the transfer shall not impair IACX's rights to the Gas or rights under this Agreement. 18.7 Memorandum of Agreement. IACX shall have the right to file a Memorandum of Agreement or any similar notice of Producer's dedication of its gas on the county records in the county where the dedicated gas is produced. 18.8 Assignment. All rights and duties under this Agreement shall inure to and be binding upon the successors and assigns of the Parties. No transfer of any interest of either Party, except a transfer to an affiliate, shall be binding upon the other Party until the other Party has been furnished with notice and a true copy of the conveyance or transfer. No transfer shall be binding on IACX until IACX, after receiving and reviewing sufficient information of the type described in Section 14.2 of this Agreement, is satisfied, in its sole discretion and in good faith, that the successor or assignee meets the creditworthiness requirements of this Agreement. Any successor or assignee will be bound by all the terms and conditions of the Agreement and must acknowledge in writing that it assumes all the obligations of its assignor or predecessor in interest. 18.9 Severability / Joint Preparation. Should any part of this Agreement be found to be unenforceable or be required to be modified by a court or governmental authority, then only that part of this Agreement shall be affected. The remainder of this Agreement shall remain in force and unmodified. If the absence or modification of the affected part of this Agreement substantially deprives either Party of the economic benefit of this Agreement, the Parties shall negotiate reasonable and enforceable provisions to restore the economic benefit to the Party so deprived consistent with the intent originally reflected in this Agreement. If the Parties are unable to do so, then either Party may terminate this Agreement by giving the other Party written notice of termination no later than sixty (60) days after the effective date of the law, regulation, rule or order affecting this Agreement. This Agreement was prepared jointly by the Parties and not by either Party to the exclusion of the other. 18.10 Remedy for Breach. Except as otherwise specifically provided herein, if either Party fails to perform any of the covenants or obligations imposed upon it in this Agreement (except where such failure is excused under the Force Majeure or other provisions hereof), then the other Party may, at its option (without waiving any other remedy for breach hereof), by notice in writing specifying the default that has occurred, indicate such Party's election to terminate this Agreement by reason thereof; provided, however, that Producer's failure to pay IACX within a period of twenty (20) days following Producer's receipt of written notice from IACX advising of such failure to make payment in full within the time specified previously herein, will be a default that gives IACX the right to seek any and all available legal and equitable remedies, including the right to immediately terminate this Agreement, unless such failure to pay such amounts is the result of a bona fide dispute between the Parties hereto regarding such amounts hereunder and Producer timely pays all amounts not in dispute. With respect to any other matters, the Party in default will have thirty (30) days from receipt of such written notice to commence the remedy of such default, and upon failure to do so the non-defaulting Party shall have the right to seek any and all available legal and equitable remediates, including the right to terminate this Agreement upon 90 days prior written notice; provided, however, that as long as the defaulting Party is taking all necessary actions, on a best efforts basis, to remedy such default, the non-defaulting Party shall not have the right to terminate this Agreement. Such termination will be in addition to and not in lieu of any available legal or equitable remedy and will not prejudice the right of the Party not in default: (i) to collect any amounts due it hereunder for any damage or loss suffered by it, (ii) to receive any quantities of gas owned by such Party, and (iii) will not waive any |

| other remedy to which the Party not in default may be entitled for breach of this Agreement. 18.11 Dispute Resolution. Excluding exigent circumstances threatening life or property, all claims, disputes and other matters in questions arising out of or relating to this Agreement, or the breach thereof, shall be resolved in accordance with this Section, which shall be the sole and exclusive procedures for the resolution of such disputes. IACX and Producer shall attempt in good faith to resolve any dispute arising out of or relating to this Agreement promptly by negotiation between officers of each Party who have authority to settle the dispute. Any Party may give the other Party written notice of any dispute not resolved in the normal course of business. Within thirty (30) Days after receipt of such notice, the receiving Party shall submit to the other a written response. The notice and the response shall include (a) a statement of the Party's position and a summary of arguments supporting that position, and (b) the name and title of the executive who will represent the Party and of any other person who will accompany the executive. Within thirty (30) Days after receipt of the disputing Party's notice, the executives ofboth Parties shall meet at a mutually acceptable time and place, and thereafter as often as they reasonably deem necessary, to attempt to resolve the dispute. The Parties may involve a third party mediator if they so choose. All reasonable requests for information made by one Party to the other will be honored. If the matter has not been resolved by these persons within ninety (90) Days of receipt of the disputing Party's notice, either Party may initiate litigation thirty (30) Days after written notice is given to the other Party; provided, that if one Party has requested the other to participate in any of the above non-binding procedures and the other has failed to participate, the requesting Party may initiate litigation before expiration of the above period. All negotiations pursuant to this section shall be confidential and shall be treated as compromise and settlement negotiations for purposes of the Federal Rules of Evidence and the New Mexico Rules of Evidence. Notwithstanding this Section and without waiving any rights or obligations of a Party hereunder, either Party may seek from any court having jurisdiction hereof any interim, provisional, or injunctive relief that may be necessary to protect the rights or property of any Party or maintain the status quo before, during or after the pendency of a mediation. Receipt of notice of the dispute shall toll the running of all statutes of limitation relating to the matters in dispute, which statutes shall remain suspended for ninety (90) Days. 18.12 Except as to matters covered by the Parties' indemnification obligations hereunder, if mediation is successful in resolving a dispute other than one arising under the indemnification obligations of this Agreement, each Party agrees to bear its own attorneys' fees and costs of investigation and defense, and each Party waives any right to recover these fees and costs from the other Party. 18.13 Information. Producer agrees to provide to IACX within a reasonable time any information that IACX needs to properly administer this Agreement including the following: (a) notice of any new wells, the production from which will be subject to this Agreement whether directly connected to IACX's system or delivered through a central Receipt Point connected to IACX's Facilities, including the most current chromatographic gas analysis, the well name, well number, meter numbers (if assigned and available), American Petroleum Institute (API) numbers, State identification Numbers, and latitude and longitude information; (b) notice of any change in the operator, including any new operator's legal name and address, and a copy of any change of operator notices filed with the appropriate state or federal agencies which Producer agrees to send to IACX within ten (10) Days of filing same; and (c) copies of any plugging and abandonment notices and reports filed with the appropriate state or federal agencies, which Producer agrees to send to IACX within ten (10) Days of filing same. 18.14 Further Assurances. From time to time after the Effective Date, the Parties shall execute and deliver further documents and instruments, and take such other and further actions, as may be reasonably requested by each Party in order to carry out the intent of this Agreement. As Producer acquires or re-acquires |

| additional leases which cover any lands included in the Dedicated Properties from time to time (or Producer or its affiliates become operator of any of such leases), Producer shall promptly cause an amendment to this Agreement to be executed reflecting the addition of such oil and gas leases to Exhibit A hereto. [End of General Terms and Conditions] |

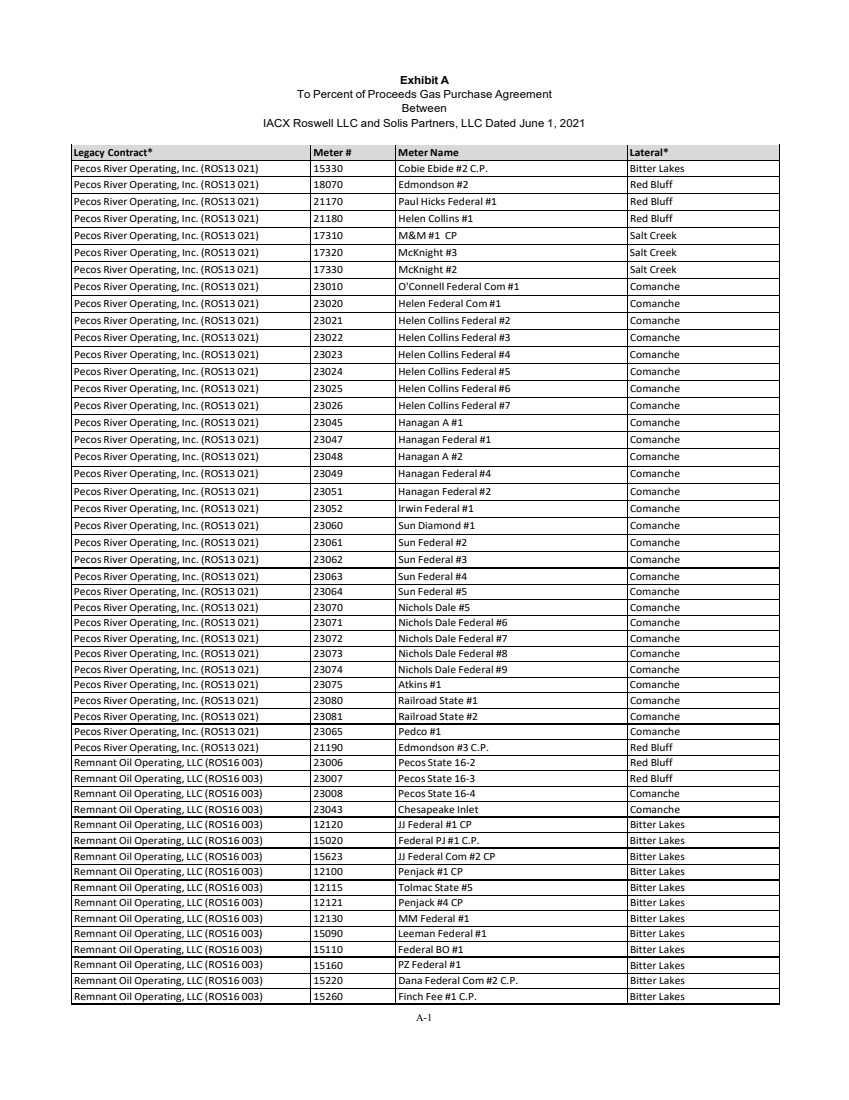

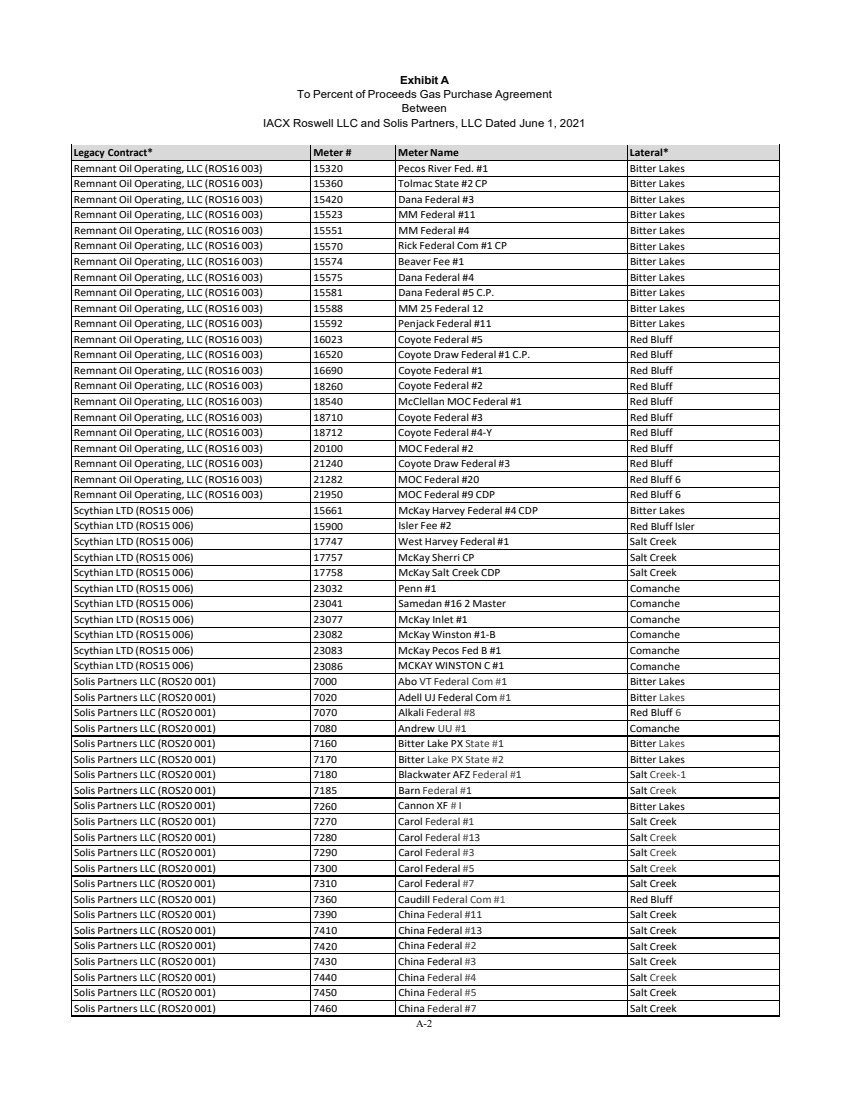

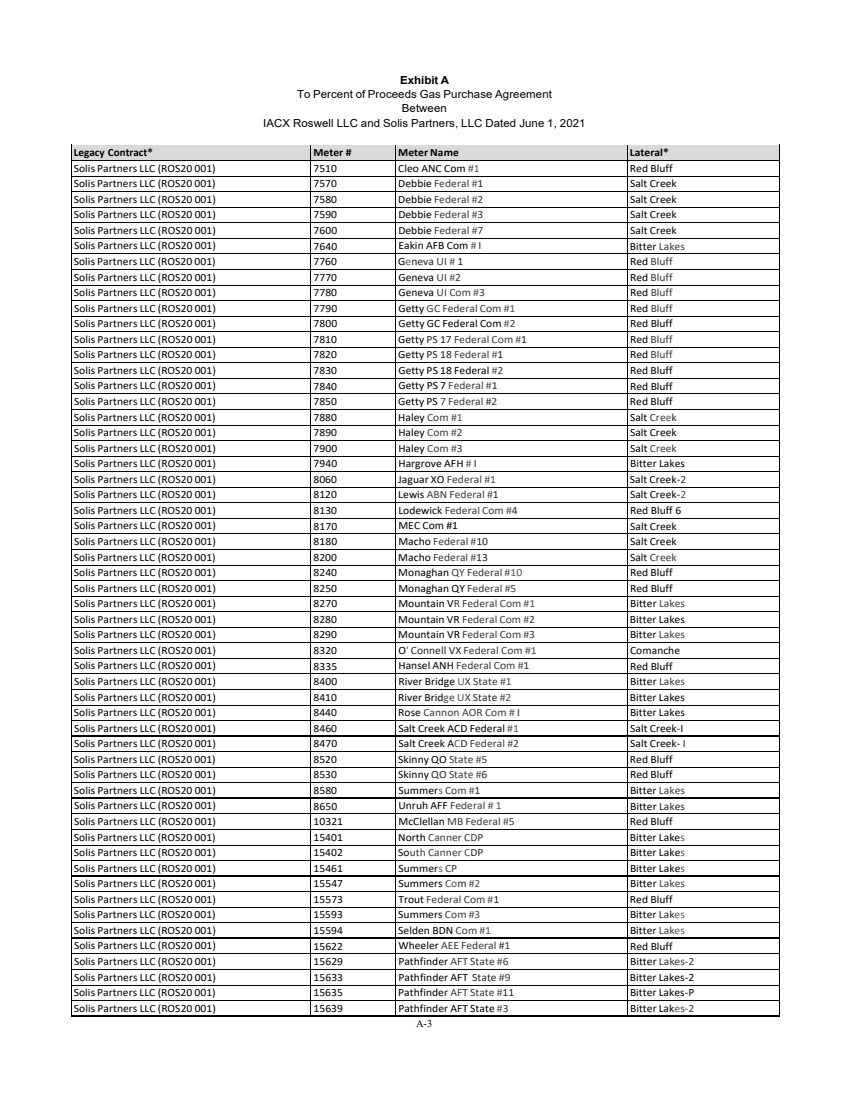

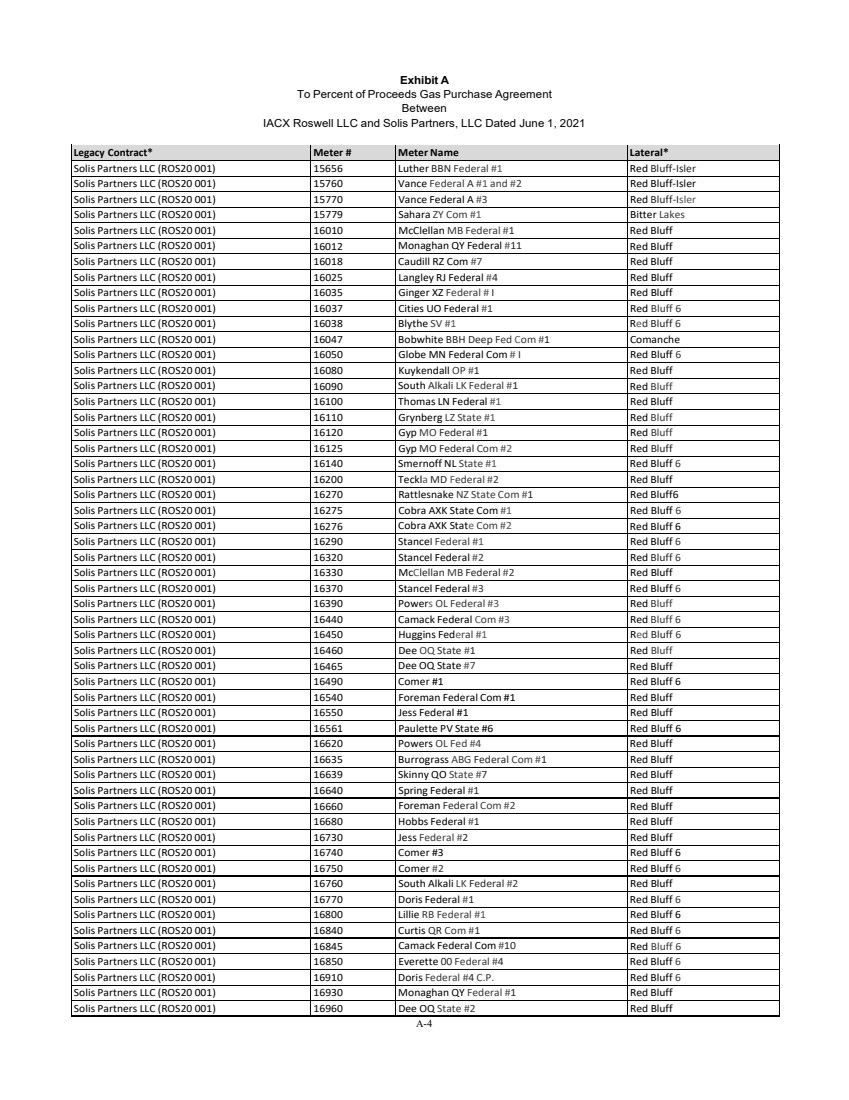

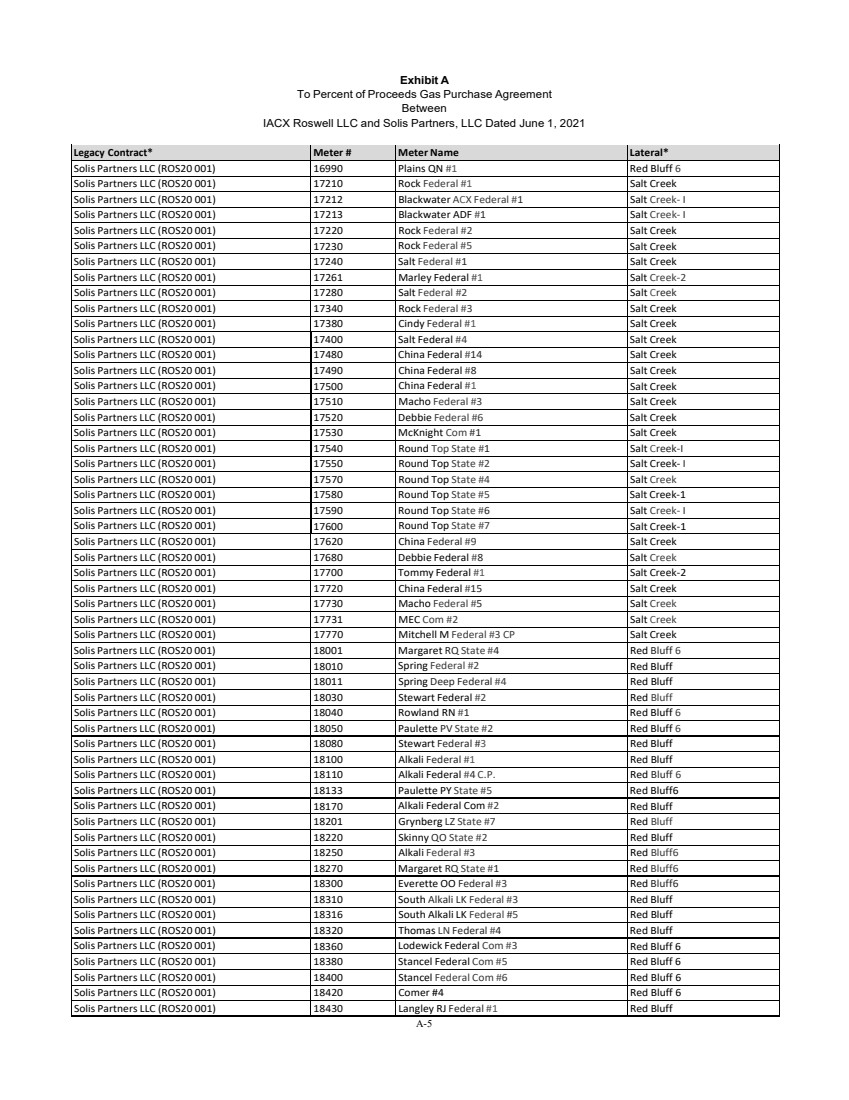

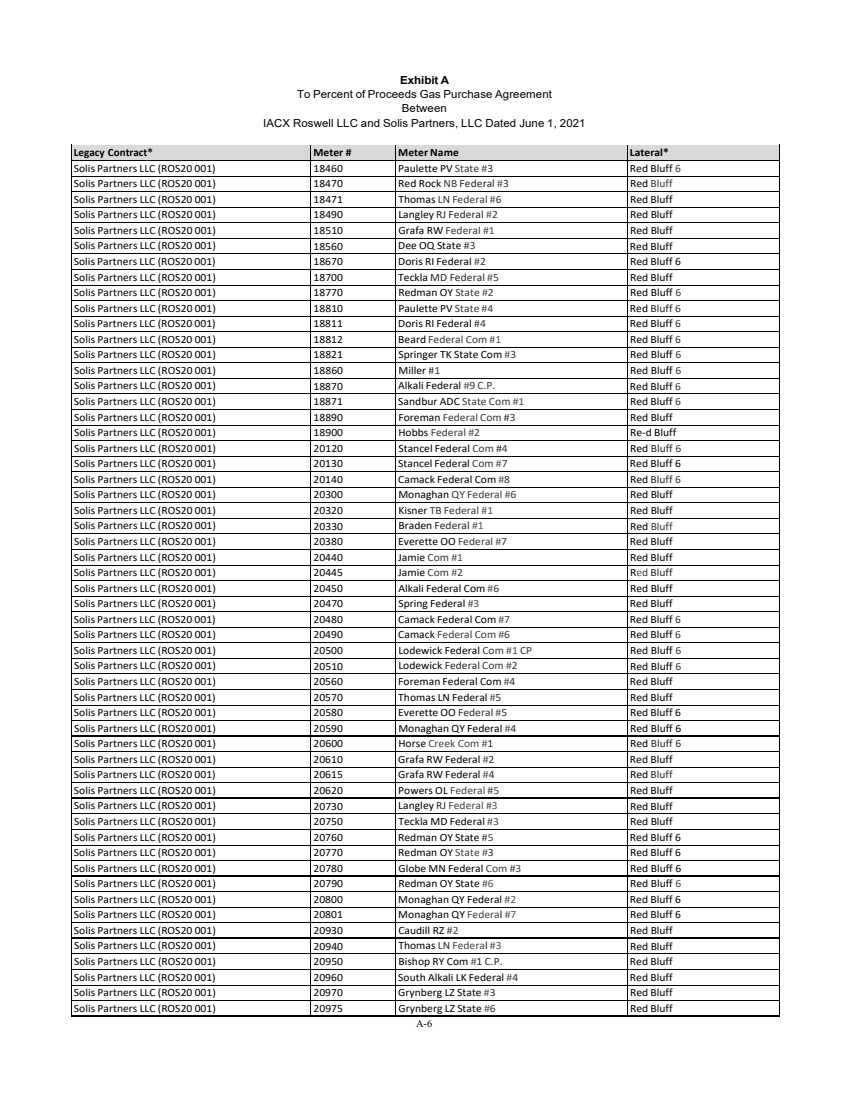

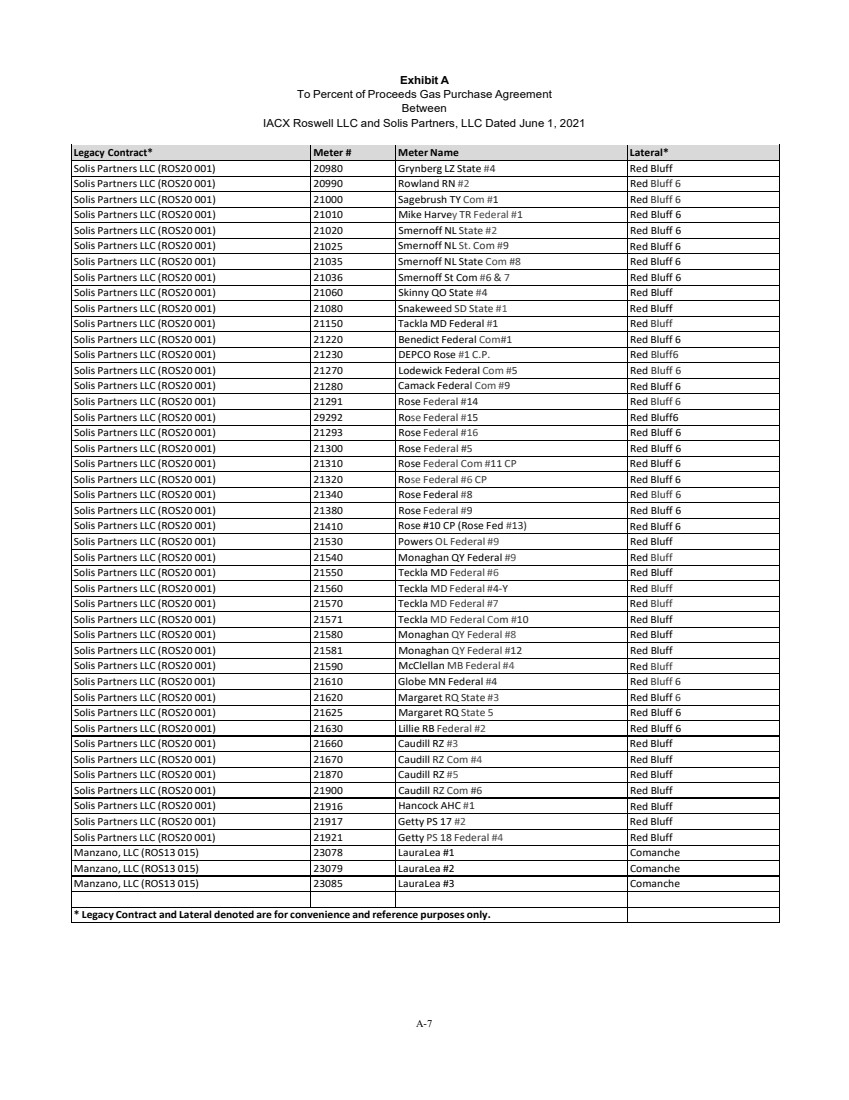

| Exhibit A To Percent of Proceeds Gas Purchase Agreement Between IACX Roswell LLC and Solis Partners, LLC Dated June 1, 2021 Legacy Contract* Meter # Meter Name Lateral* Pecos River Operating, Inc. (ROS13 021) 15330 Cobie Ebide #2 C.P. Bitter Lakes Pecos River Operating, Inc. (ROS13 021) 18070 Edmondson #2 Red Bluff Pecos River Operating, Inc. (ROS13 021) 21170 Paul Hicks Federal #1 Red Bluff Pecos River Operating, Inc. (ROS13 021) 21180 Helen Collins #1 Red Bluff Pecos River Operating, Inc. (ROS13 021) 17310 M&M #1 CP Salt Creek Pecos River Operating, Inc. (ROS13 021) 17320 McKnight #3 Salt Creek Pecos River Operating, Inc. (ROS13 021) 17330 McKnight #2 Salt Creek Pecos River Operating, Inc. (ROS13 021) 23010 O'Connell Federal Com #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23020 Helen Federal Com #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23021 Helen Collins Federal #2 Comanche Pecos River Operating, Inc. (ROS13 021) 23022 Helen Collins Federal #3 Comanche Pecos River Operating, Inc. (ROS13 021) 23023 Helen Collins Federal #4 Comanche Pecos River Operating, Inc. (ROS13 021) 23024 Helen Collins Federal #5 Comanche Pecos River Operating, Inc. (ROS13 021) 23025 Helen Collins Federal #6 Comanche Pecos River Operating, Inc. (ROS13 021) 23026 Helen Collins Federal #7 Comanche Pecos River Operating, Inc. (ROS13 021) 23045 Hanagan A #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23047 Hanagan Federal #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23048 Hanagan A #2 Comanche Pecos River Operating, Inc. (ROS13 021) 23049 Hanagan Federal #4 Comanche Pecos River Operating, Inc. (ROS13 021) 23051 Hanagan Federal #2 Comanche Pecos River Operating, Inc. (ROS13 021) 23052 Irwin Federal #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23060 Sun Diamond #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23061 Sun Federal #2 Comanche Pecos River Operating, Inc. (ROS13 021) 23062 Sun Federal #3 Comanche Pecos River Operating, Inc. (ROS13 021) 23063 Sun Federal #4 Comanche Pecos River Operating, Inc. (ROS13 021) 23064 Sun Federal #5 Comanche Pecos River Operating, Inc. (ROS13 021) 23070 Nichols Dale #5 Comanche Pecos River Operating, Inc. (ROS13 021) 23071 Nichols Dale Federal #6 Comanche Pecos River Operating, Inc. (ROS13 021) 23072 Nichols Dale Federal #7 Comanche Pecos River Operating, Inc. (ROS13 021) 23073 Nichols Dale Federal #8 Comanche Pecos River Operating, Inc. (ROS13 021) 23074 Nichols Dale Federal #9 Comanche Pecos River Operating, Inc. (ROS13 021) 23075 Atkins #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23080 Railroad State #1 Comanche Pecos River Operating, Inc. (ROS13 021) 23081 Railroad State #2 Comanche Pecos River Operating, Inc. (ROS13 021) 23065 Pedco #1 Comanche Pecos River Operating, Inc. (ROS13 021) 21190 Edmondson #3 C.P. Red Bluff Remnant Oil Operating, LLC (ROS16 003) 23006 Pecos State 16‐2 Red Bluff Remnant Oil Operating, LLC (ROS16 003) 23007 Pecos State 16‐3 Red Bluff Remnant Oil Operating, LLC (ROS16 003) 23008 Pecos State 16‐4 Comanche Remnant Oil Operating, LLC (ROS16 003) 23043 Chesapeake Inlet Comanche Remnant Oil Operating, LLC (ROS16 003) 12120 JJ Federal #1 CP Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 15020 Federal PJ #1 C.P. Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 15623 JJ Federal Com #2 CP Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 12100 Penjack #1 CP Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 12115 Tolmac State #5 Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 12121 Penjack #4 CP Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 12130 MM Federal #1 Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 15090 Leeman Federal #1 Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 15110 Federal BO #1 Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 15160 PZ Federal #1 Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 15220 Dana Federal Com #2 C.P. Bitter Lakes Remnant Oil Operating, LLC (ROS16 003) 15260 Finch Fee #1 C.P. Bitter Lakes A-1 |