| 1 November 2024 HELIUM CORP |

| 2 Disclaimer This presentation (this “Presentation”) is provided solely for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity or debt. It has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between New Era Helium Corp., a Nevada corporation (“New Era”) and Roth CH Acquisition V Co., a Delaware corporation (“ROCL” and related transactions (the “Proposed Business Combination”) and for no other purpose. On January 3, 2024, ROCL and New Era entered into a Business Combination Agreement and Plan of Reorganization (as amended on June 5, 2024, August 8, 2024, September 11, 2024, and as it may be further amended, supplemented or otherwise modified from time to time, the “Merger Agreement”). This Presentation is highly confidential and proprietary to New Era and may not be reproduced or otherwise disseminated, in whole or in part, without the prior written consent of New Era. The information contained herein does not purport to be all-inclusive. The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. ROCL and New Era assume no obligation to update the information in this presentation, except as required by law. Furthermore, any and all trademarks and trade names referred to in this presentation are the property of their respective owners. No Representation or Warranties All information is provided “AS IS” and no representations or warranties, of any kind, express or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will ROCL, New Era or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither ROCL nor New Era has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of New Era or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of the company and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but New Era will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Use of Projections This Presentation contains projected financial information with respect to ROCL and New Era. Such projected financial information constitutes forward-looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward-Looking Statements” below. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. |

| 3 Disclaimer Industry and Market Data In this Presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which New Era competes and other industry data. We obtained this information and statistics from third-party sources, including reports by market research firms and company filings. Financial Information; Non-GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement/prospectus or registration statement to be filed by ROCL with the SEC, and such differences may be material. In particular, all New Era projected financial information included herein is preliminary and subject to risks and uncertainties. Any variation between New Era’s actual results and the projected financial information included herein may be material. This presentation also contains non-GAAP financial measures and key metrics relating to the combined company’s projected future performance. A reconciliation of these non-GAAP financial measures to the corresponding GAAP measures on a forward-looking basis is not available because the various reconciling items are difficult to predict and subject to constant change. No Offer or Solicitation This Presentation does not constitute a proxy statement or solicitation of a proxy, consent, vote or authorization with respect to any securities or in respect of the Proposed Business Combination and shall not constitute an offer to sell or exchange, or a solicitation of an offer to buy or exchange any securities, nor shall there be any sale, issuance or transfer of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATIONTO THE CONTRARY IS A CRIMINAL OFFENSE. Important Information About the Proposed Business Combination and Where to Find It In connection with the Proposed Business Combination, Roth CH V Holdings, Inc., a Nevada corporation and a wholly-owned subsidiary of ROCL (“Holdings”) has filed with the SEC a registration statement on Form S-4, which includes a definitive proxy statement of ROCL and a prospectus of Holdings for the registration of Holdings securities (as amended from time to time, the “Registration Statement”). A full description of the terms of the Proposed Business Combination is provided in the Registration Statement. ROCL urges investors, stockholders and other interested persons to read the Registration Statement and the definitive proxy statement/prospectus, as well as other documents filed with the SEC because these documents will contain important information about Holdings, ROCL, New Era and the Proposed Business Combination. The Registration Statement has been declared effective by the SEC, and the definitive proxy statement/prospectus and other relevant documents have been mailed to stockholders of ROCL as of a record date established for voting on the Proposed Business Combination. Stockholders and other interested persons will also be able to obtain a copy of the proxy statement, without charge, by directing a request to: Roth CH Acquisition V Co., 888 San Clemente Drive, Suite 400, Newport Beach, CA 92660. The definitive proxy statement/prospectus, can also be obtained, without charge, at the SEC's website (www.sec.gov). The information contained on, or that may be accessed through, the websites referenced in this Presentation is not incorporated by reference into, and is not a part of, this Presentation. Participants in the Solicitation ROCL, New Era and their respective directors and executive officers may be considered participants in the solicitation of proxies with respect to the Proposed Business Combination described herein under the rules of the SEC. Information about such persons and a description of their interests will be contained in the Registration Statement when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated above. |

| 4 Forward Looking Statements This Presentation contains forward-looking statements including, but not limited to, ROCL’s and New Era’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends,” or similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in ROCL’s final prospectus for its initial public offering, filed with the SEC on December 2, 2021, under the heading “Risk Factors.” These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and ROCL and New Era believe there is a reasonable basis for them. However, there can be no assurance that the events, results or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and neither ROCL nor New Era is under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. In addition to factors previously disclosed in ROCL’s reports filed with the SEC and those identified elsewhere in this Presentation, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: (i) expectations regarding New Era’s strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and New Era’s ability to invest in growth initiatives and pursue acquisition opportunities; (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (iii) the outcome of any legal proceedings that may be instituted against ROCL or New Era following announcement of the Proposed Business Combination and the transactions contemplated thereby; (iv) the inability to complete the Proposed Business Combination due to, among other things, the failure to obtain ROCL stockholder approval on the expected terms and schedule, as well as the risk that regulatory approvals required for the Proposed Business Combination are not obtained or are obtained subject to conditions that are not anticipated; (v) the failure to meet the minimum cash requirements of the Merger Agreement due to ROCL stockholder redemptions and the failure to obtain replacement financing; the inability to complete the concurrent PIPE; (vi) the risk that the Proposed Business Combination or another business combination may not be completed by ROCL’s business combination deadline and the potential failure to obtain an extension of the business combination deadline; (vii) the risk that the announcement and consummation of the Proposed Business Combination disrupts New Era’s current operations and future plans; (viii) the ability to recognize the anticipated benefits of the Proposed Business Combination; (ix) unexpected costs related to the Proposed Business Combination; (x) the amount of any redemptions by existing holders of the ROCL common stock being greater than expected; (xi) limited liquidity and trading of ROCL’s securities; (xii) the inability to obtain or maintain the listing of the combined company’s common stock on Nasdaq following the Proposed Business Combination, including but not limited to the failure to meet Nasdaq’s initial listing standards in connection with the consummation of the Proposed Business Combination; (xiii) geopolitical risk and changes in applicable laws or regulations; (xiv) the possibility that ROCL and/or New Era may be adversely affected by other economic, business, and/or competitive factors; (xv) operational risk; (xvi) risk that the COVID-19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on our business operations, as well as our financial condition and results of operations; and (xvii) the risks that the consummation of the Proposed Business Combination is substantially delayed or does not occur. Any financial projections in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond ROCL’s and New Era’s control. While all projections are necessarily speculative, ROCL and New Era believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of projections in this Presentation should not be regarded as an indication that ROCL and New Era, or their representatives, considered or consider the projections to be a reliable prediction of future events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actualresults. The foregoing list of factors is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in ROCL and is not intended to form the basis of an investment decision in ROCL. Readers should carefully review the foregoing factors and other risks and uncertainties described in the “Risk Factors” section of the Registration Statement and the other reports, which ROCL has filed or will file from time to time with the SEC. There may be additional risks that neither ROCL nor New Era presently know, or that ROCL and New Era currently believe are immaterial, that could cause actual results to differ from those contained in forward looking statements. For these reasons, among others, investors and other interested persons are cautioned not to place undue reliance upon any forward-looking statements in this Presentation. All subsequent written and oral forward-looking statements concerning ROCL and New Era, the Proposed Business Combination or other matters and attributable to ROCL and New Era or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. |

| 5 Glossary of Abbreviations BBL: Barrels (equal to 42 US gallons) BBL/D: Barrels per day BCF: Billions of cubic feet BCFE: Billions of cubic feet equivalent BOE: Barrels of oil equivalent (1 barrel of oil or 6,000 cubic feet of natural gas) CAGR: Compound annual growth rate G&A: General and administrative expenses LOE: Lease operating expense MBOE: Thousands of barrels of oil equivalent MCF: Thousands of cubic feet MCFE: Thousands of cubic feet of natural gas equivalent (6,000 cubic feet of natural gas or 1 barrel of oil) MCF/D: Thousands of cubic feet per day MMBOE: Millions of barrels of oil equivalent MM: Millions MMCF: Millions of cubic feet MMCF/D: Millions of cubic feet per day MMCFE: Millions of cubic feet equivalent MMCFE/D: Millions of cubic feet equivalent per day MMCF p.a.: Millions of cubic feet per annum MMSCF/yr: Millions of standard cubic feet per year MOL%: Mole percent NGL: Natural gas liquid SCF: Standard cubic feet SCF/D: Standard cubic feet per day SCF/yr: Standard cubic feet per year WI: Working interest |

| 6 The Roth CH Team Overview of Roth CH Acquisition Co. ROCL • Roth CH Acquisition V Co. (“Roth CH” or “ROCL”) completed its IPO in December 2021 and currently has ~$17.9 million cash in trust • The Roth CH team is composed of proven operators and capital markets professionals who have long-standing relationships with leading institutional and private investors Unique Experience • The Roth CH team are serial SPAC sponsors and have successfully completed multiple prior SPAC business combinations with growth-stage companies • In addition to serving as SPAC sponsors, the Roth CH team has been active in all roles of the SPAC process—from formation, to capital raising, to aftermarket advisory services • Since 2020, the Roth CH team has completed four business combinations serving as sponsors, helped raise over $1 billion in SPAC financings, and advised on numerous others The Roth CH Advantage • The Roth CH team seeks to leverage the extensive history and successful track record of two leading growth investment banks (Roth Capital Partners and Craig-Hallum Capital Group) by utilizing its combined full-service investment banking platforms and its dedicated SPAC teams to bring a compelling growth company to the market • In its position, the team has a unique ability to drive value and support beyond a business combination with dedicated and industry specific aftermarket support ROCL Overview • The RothCH team is a highly experienced sponsor with extensive SPAC transaction experience • Byron Roth, Co-CEO and Co-Chairman • Mr. Roth has been the Chairman and Chief Executive Officer of Roth since 1998. Under his management the firm has helped raise over $75 billion for small-cap companies, as well as advising on many merger and acquisition transactions • John Lipman, Co-CEO and Co-Chairman • Mr. Lipman is a Managing Partner of Investment Banking at Craig-Hallum. Mr. Lipman joined Craig-Hallum in 2012 and has more than 20 years of investment banking experience completing over 200 financings for growth companies Deep Management team comprised of individuals from Roth Capital Partners, LLC and Craig-Hallum Capital Group |

| 7 What ROCL Likes About New Era Globally scarce industrial gas commodity, utilized in rapidly growing high tech markets Will be US-Listed, North American helium platform positioned to participate in consolidation of exploration start-ups and midstream players Experienced executive team and board, with expertise in both helium and conventional gas development Proved and probable helium resource strategically located in Southeastern New Mexico in the Permian Basin Secured two (2) 10-year take-or-pay offtake agreements with international helium buyers (estimated $113 million(1) helium revenue generation) Vertically integrated, scalable helium operation with a focus on producing Responsibly Sourced Gas (RSG) and Responsibly Sourced Helium (RSH )(2) (1) Helium revenues are net of royalties, transportation and tolling services. Estimates are prepared by New Era Helium management (2) RSH is trademarked by New Era Helium Helium, An Undersupplied Mission Critical Element A U.S. Platform for Growth & Consolidation Vertical Integration of the Helium Supply Chain Experienced Executive Team and Board Proved Reserves as a Differentiator Secured Long-Term Helium Offtake |

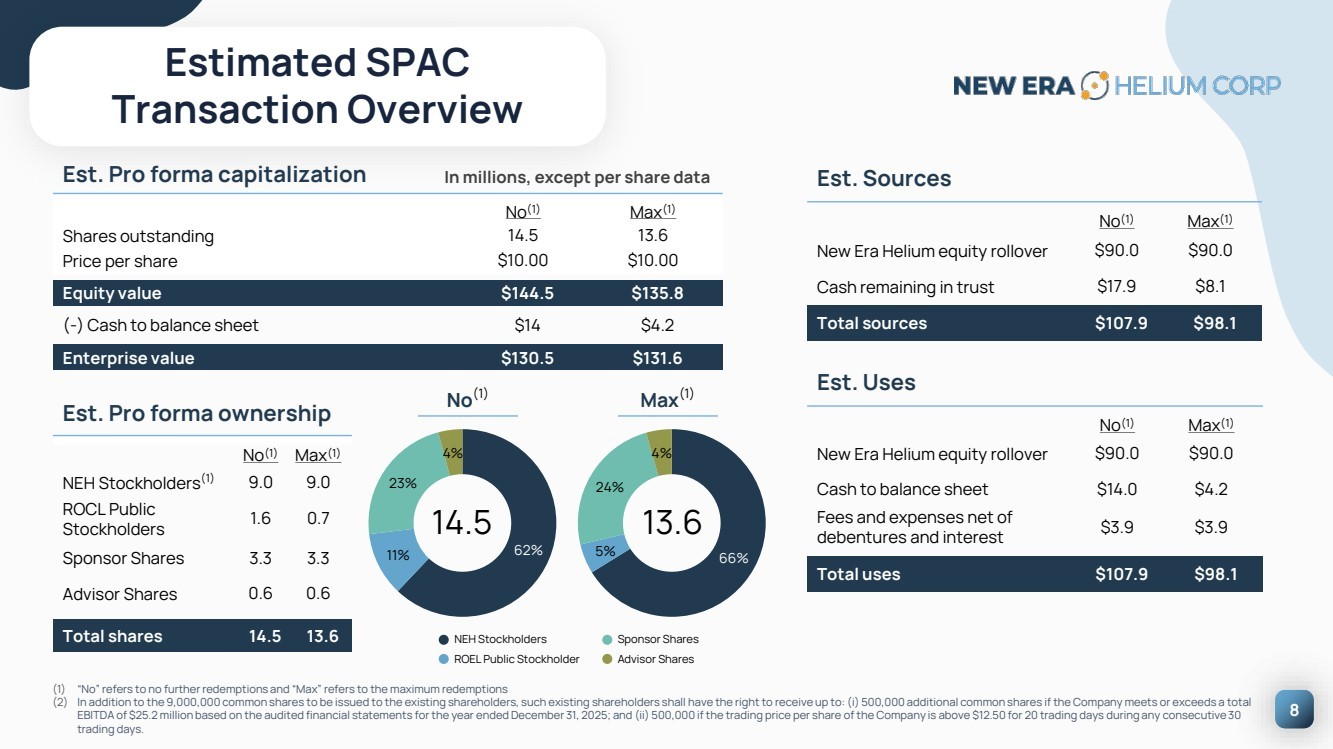

| 8 66% 5% 24% 4% Estimated SPAC Transaction Overview 8 Est. Pro forma capitalization In millions, except per share data No(1) Max(1) Shares outstanding 14.5 13.6 Price per share $10.00 $10.00 Equity value $144.5 $135.8 (-) Cash to balance sheet $14 $4.2 Enterprise value $130.5 $131.6 Est. Pro forma ownership No(1) Max(1) NEH Stockholders(1) 9.0 9.0 ROCL Public Stockholders 1.6 0.7 Sponsor Shares 3.3 3.3 Advisor Shares 0.6 0.6 Total shares 14.5 13.6 Est. Sources No(1) Max(1) New Era Helium equity rollover $90.0 $90.0 Cash remaining in trust $17.9 $8.1 Total sources $107.9 $98.1 Est. Uses No(1) Max(1) New Era Helium equity rollover $90.0 $90.0 Cash to balance sheet $14.0 $4.2 Fees and expenses net of debentures and interest $3.9 $3.9 Total uses $107.9 $98.1 (1) “No” refers to no further redemptions and “Max” refers to the maximum redemptions (2) In addition to the 9,000,000 common shares to be issued to the existing shareholders, such existing shareholders shall have the right to receive up to: (i) 500,000 additional common shares if the Company meets or exceeds a total EBITDA of $25.2 million based on the audited financial statements for the year ended December 31, 2025; and (ii) 500,000 if the trading price per share of the Company is above $12.50 for 20 trading days during any consecutive 30 trading days. 11% 62% 23% 4% ROEL Public Stockholder NEH Stockholders Sponsor Shares Advisor Shares No(1) Max(1) 14.5 13.6 |

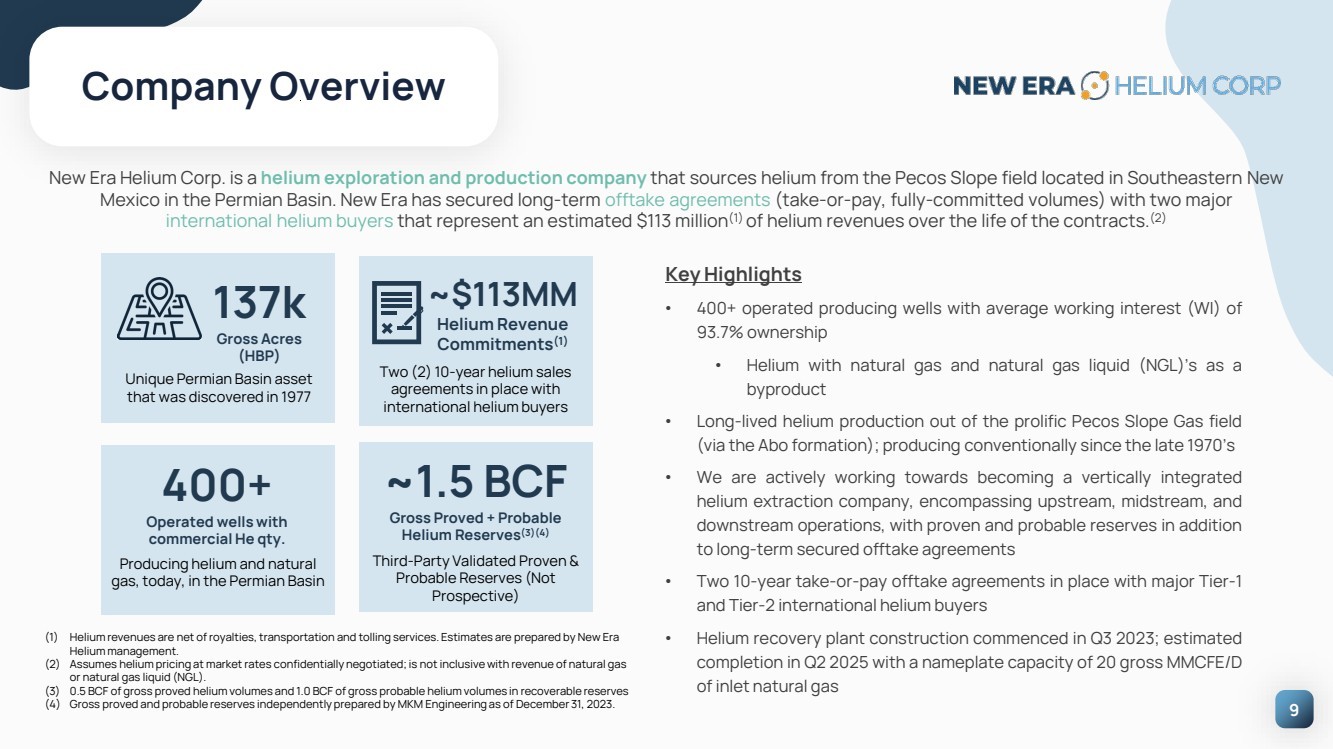

| 9 Company Overview New Era Helium Corp. is a helium exploration and production company that sources helium from the Pecos Slope field located in Southeastern New Mexico in the Permian Basin. New Era has secured long-term offtake agreements (take-or-pay, fully-committed volumes) with two major international helium buyers that represent an estimated $113 million(1) of helium revenues over the life of the contracts.(2) Key Highlights • 400+ operated producing wells with average working interest (WI) of 93.7% ownership • Helium with natural gas and natural gas liquid (NGL)’s as a byproduct • Long-lived helium production out of the prolific Pecos Slope Gas field (via the Abo formation); producing conventionally since the late 1970’s • We are actively working towards becoming a vertically integrated helium extraction company, encompassing upstream, midstream, and downstream operations, with proven and probable reserves in addition to long-term secured offtake agreements • Two 10-year take-or-pay offtake agreements in place with major Tier-1 and Tier-2 international helium buyers • Helium recovery plant construction commenced in Q3 2023; estimated completion in Q2 2025 with a nameplate capacity of 20 gross MMCFE/D of inlet natural gas Producing helium and natural gas, today, in the Permian Basin Two (2) 10-year helium sales agreements in place with international helium buyers ~$113MM Helium Revenue Commitments(1) 137k Gross Acres (HBP) 400+ Operated wells with commercial He qty. Third-Party Validated Proven & Probable Reserves (Not Prospective) ~1.5 BCF Gross Proved + Probable Helium Reserves(3)(4) Unique Permian Basin asset that was discovered in 1977 (1) Helium revenues are net of royalties, transportation and tolling services. Estimates are prepared by New Era Helium management. (2) Assumes helium pricing at market rates confidentially negotiated; is not inclusive with revenue of natural gas or natural gas liquid (NGL). (3) 0.5 BCF of gross proved helium volumes and 1.0 BCF of gross probable helium volumes in recoverable reserves (4) Gross proved and probable reserves independently prepared by MKM Engineering as of December 31, 2023. |

| 10 [picture] [picture] [picture] [picture] [picture] [picture] Expected start of delivering helium to buyers Revenue generation derived from three streams Two (2) 10-year helium sales agreements in place with major helium buyers Producing helium and natural gas in the Permian Basin Substantial reserve base with high-purity helium Key strategic partnerships New Era At a Glance 2Q25 3-stream (He, Nat Gas, Natural Gas Liquid) ~1.5 BCF 2P Helium Reserves (2) Permian Basin: Strategic location for helium production 36.0 MMCF p.a. ~4.2 MMCF/D(1) (1) Includes gross daily production of natural gas as of August 2024; includes helium concentration that does not contribute to revenue. (2) 0.5 BCF of gross proved helium volumes and 1.0 BCF of gross probable helium volumes in recoverable reserves. Gross proved and probable reserves as prepared by MKM Engineering as of December 31, 2023. NEH engaged MKM Engineering as an independent reserve auditor to prepare the report. Neither the engagement nor the compensation is contingent on results or future production rates for the subject properties. (3) Kornbluth Helium Consulting, LLC. Plant capacity will represent ~1.6% of domestic 2023 He demand. ~1.6% Est. U.S. He Market Share(3) |

| 11 Board of Directors Years of experience: 19 years Background: Co-Founder of New Era Helium and partner at Solis Partners, LLC. Mr. Gray has oil and gas experience spanning 19 years, having directly operated over 950 wells located in New Mexico, Texas, and Oklahoma since 2005. Mr. Gray has a specialization in conventional oil and gas assets Prior Company Experience: E. Will Gray II Chairman & CEO Years of experience: 41 years Background: Executive in the chemical and industrial gas industries, President of Kornbluth Helium Consulting, LLC. and former VP/General Manager of Global Helium for both BOC Gases and the Matheson Gas subsidiary of Nippon Sanso Holdings. Prior Company Experience: Years of experience: 35 years Background: An experienced entrepreneur and public policy leader, having served in C-Level leadership roles for energy- related companies and as a U.S. Representative for Texas, where he chaired the Republican Study Committee Serves on multiple boards, including as Chairman of the Texas’ Electric Grid at ERCOT and Director of CO2 Energy Transitions LLC Prior Experience: Bill Flores Audit Committee Chairman Years of experience: 40 years Background: Executive in the chemical and industrial gas industries, Ran a consulting practice focused on Commercial Excellence that has completed projects in pricing and sales effectiveness. Has also served as an advisor to Acme Cryogenics Prior Company Experience: Stan Borowiec Independent Director Years of experience: 13 years Background: Developed and commercialized energy transition technologies, overseeing over $1B in infrastructure builds, e.g. largest sustainable jet fuel offtake deal. Generated billions in value by aligning capital providers, corporates, and tech founders, driving operational excellence within portfolio companies. Prior Company Experience: Charles Nelson Compensation Committee Chairman Phil Kornbluth Governance and Nominating Committee Chairman |

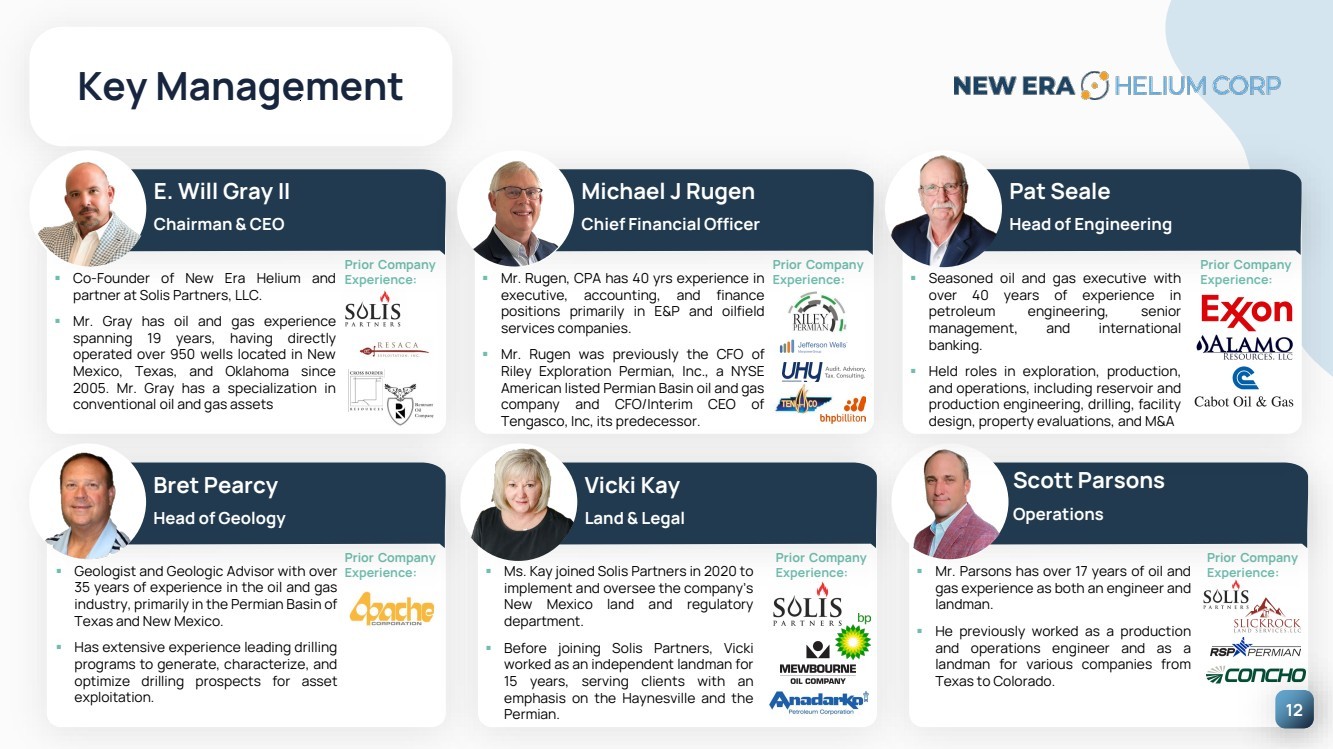

| 12 Key Management Co-Founder of New Era Helium and partner at Solis Partners, LLC. Mr. Gray has oil and gas experience spanning 19 years, having directly operated over 950 wells located in New Mexico, Texas, and Oklahoma since 2005. Mr. Gray has a specialization in conventional oil and gas assets Prior Company Experience: E. Will Gray II Chairman & CEO Mr. Rugen, CPA has 40 yrs experience in executive, accounting, and finance positions primarily in E&P and oilfield services companies. Mr. Rugen was previously the CFO of Riley Exploration Permian, Inc., a NYSE American listed Permian Basin oil and gas company and CFO/Interim CEO of Tengasco, Inc, its predecessor. Prior Company Experience: Michael J Rugen Chief Financial Officer Prior Company Experience: Bret Pearcy Head of Geology Ms. Kay joined Solis Partners in 2020 to implement and oversee the company’s New Mexico land and regulatory department. Before joining Solis Partners, Vicki worked as an independent landman for 15 years, serving clients with an emphasis on the Haynesville and the Permian. Prior Company Experience: Vicki Kay Land & Legal Mr. Parsons has over 17 years of oil and gas experience as both an engineer and landman. He previously worked as a production and operations engineer and as a landman for various companies from Texas to Colorado. Prior Company Experience: Scott Parsons Operations Seasoned oil and gas executive with over 40 years of experience in petroleum engineering, senior management, and international banking. Held roles in exploration, production, and operations, including reservoir and production engineering, drilling, facility design, property evaluations, and M&A Prior Company Experience: Pat Seale Head of Engineering Geologist and Geologic Advisor with over 35 years of experience in the oil and gas industry, primarily in the Permian Basin of Texas and New Mexico. Has extensive experience leading drilling programs to generate, characterize, and optimize drilling prospects for asset exploitation. 12 |

| 13 Unique Properties of Helium Colorless, odorless, tasteless gas Chemically and Radiologically inert – Helium is non-reactive and does not become radioactive Second lightest element & second smallest molecule Lightest & smallest that does not burn Helium has the lowest condensation point of any element -452.2 degrees F, -269 degrees C, 4.2 degrees K Liquid Helium is the coldest substance on the planet Helium remains liquid even at absolute zero Gaseous Helium has a very high specific heat and thermal conductivity He Helium 2 |

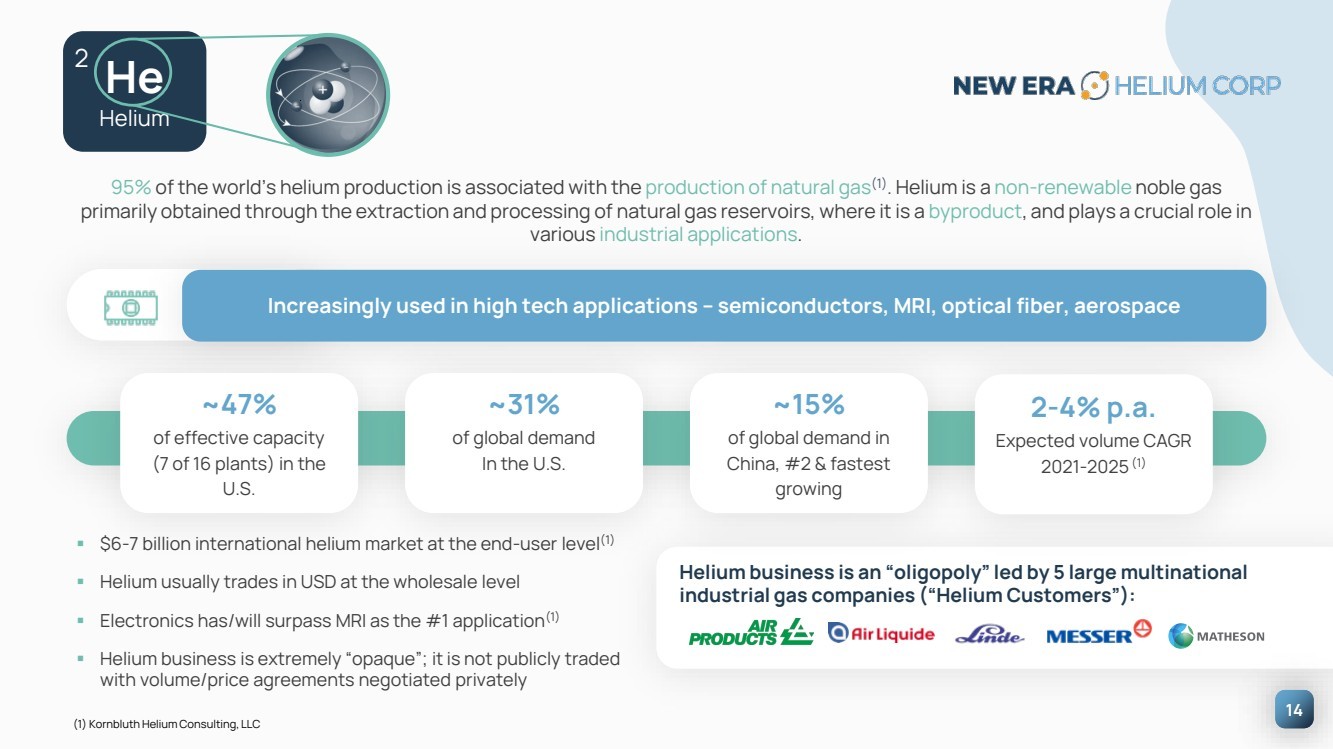

| 14 95% of the world’s helium production is associated with the production of natural gas(1). Helium is a non-renewable noble gas primarily obtained through the extraction and processing of natural gas reservoirs, where it is a byproduct, and plays a crucial role in various industrial applications. 14 Increasingly used in high tech applications – semiconductors, MRI, optical fiber, aerospace $6-7 billion international helium market at the end-user level(1) Helium usually trades in USD at the wholesale level Electronics has/will surpass MRI as the #1 application(1) Helium business is extremely “opaque”; it is not publicly traded with volume/price agreements negotiated privately Helium business is an “oligopoly” led by 5 large multinational industrial gas companies (“Helium Customers”): ~47% of effective capacity (7 of 16 plants) in the U.S. ~31% of global demand In the U.S. ~15% of global demand in China, #2 & fastest growing 2-4% p.a. Expected volume CAGR 2021-2025(1) (1) Kornbluth Helium Consulting, LLC He Helium 2 |

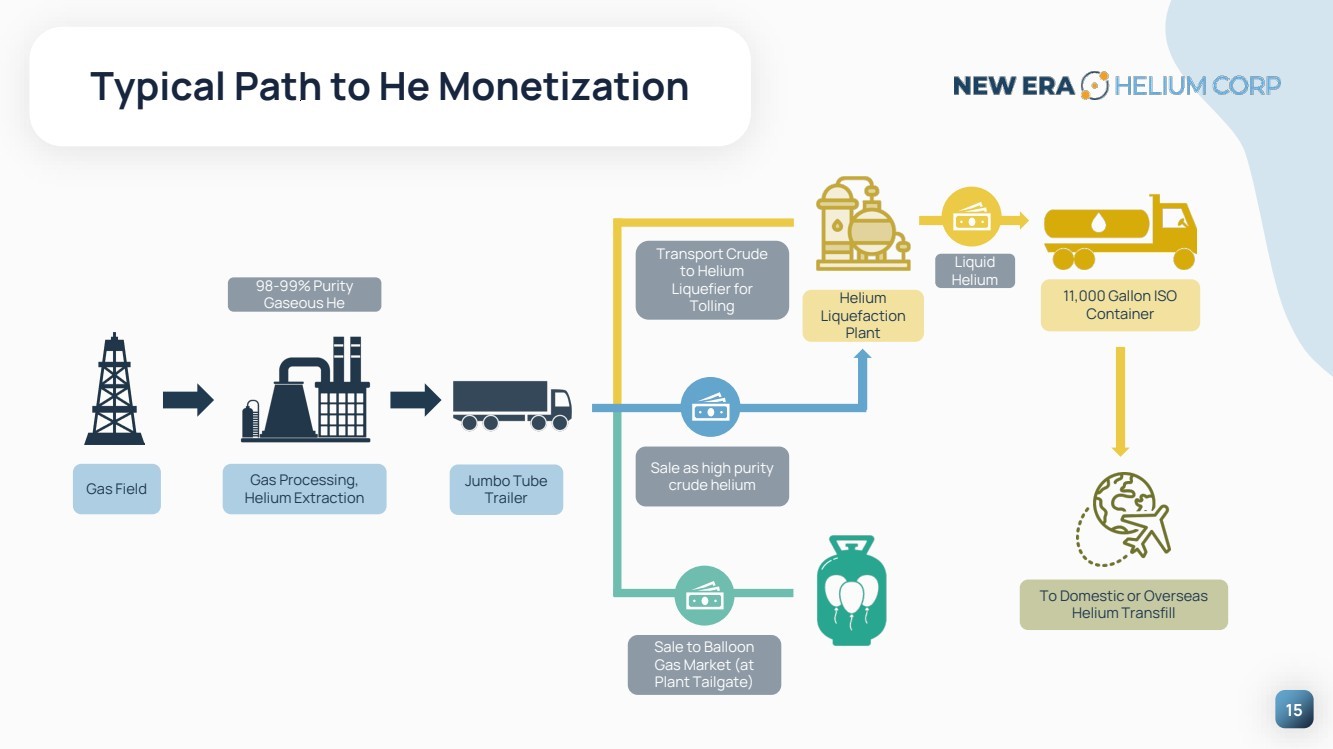

| 15 Typical Path to He Monetization Gas Field Gas Processing, Helium Extraction 98-99% Purity Gaseous He Jumbo Tube Trailer Helium Liquefaction Plant Sale to Balloon Gas Market (at Plant Tailgate) 11,000 Gallon ISO Container Liquid Helium To Domestic or Overseas Helium Transfill Transport Crude to Helium Liquefier for Tolling Sale as high purity crude helium |

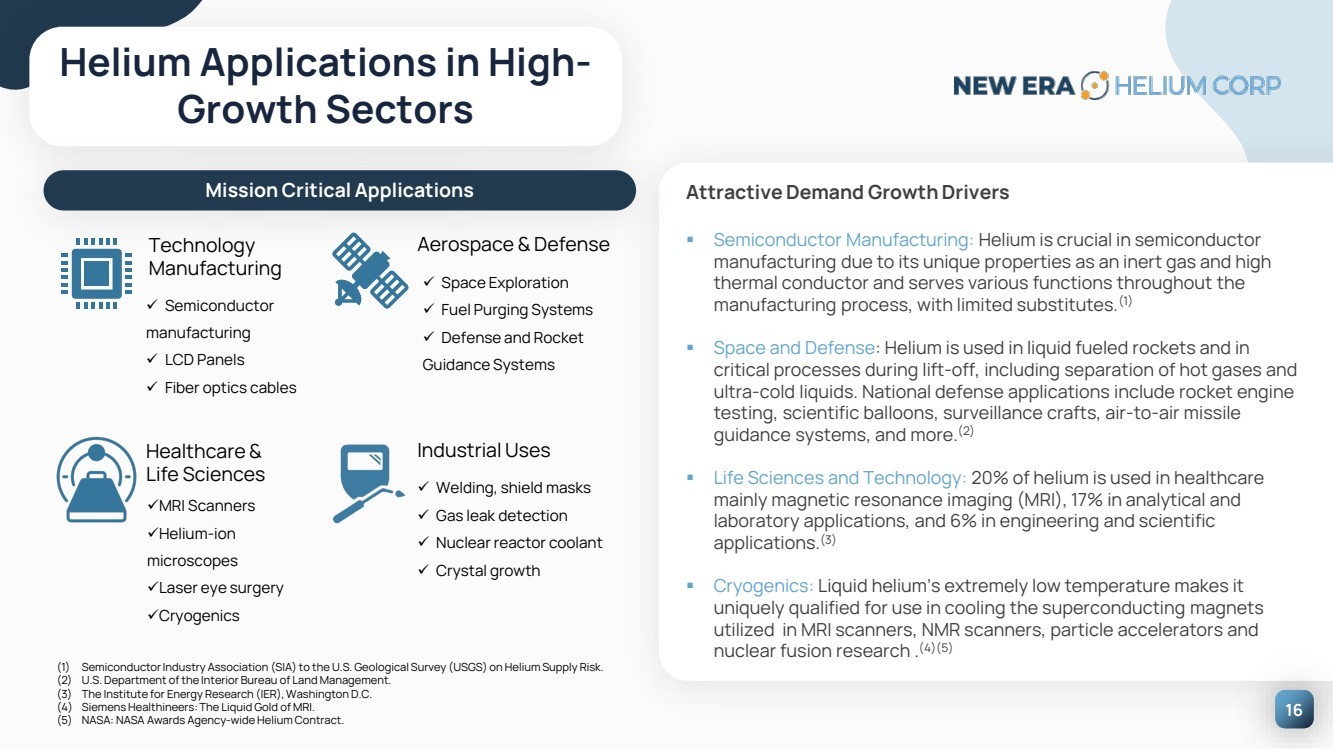

| 16 Helium Applications in High-Growth Sectors Attractive Demand Growth Drivers Semiconductor Manufacturing: Helium is crucial in semiconductor manufacturing due to its unique properties as an inert gas and high thermal conductor and serves various functions throughout the manufacturing process, with limited substitutes.(1) Space and Defense: Helium is used in liquid fueled rockets and in critical processes during lift-off, including separation of hot gases and ultra-cold liquids. National defense applications include rocket engine testing, scientific balloons, surveillance crafts, air-to-air missile guidance systems, and more.(2) Life Sciences and Technology: 20% of helium is used in healthcare mainly magnetic resonance imaging (MRI), 17% in analytical and laboratory applications, and 6% in engineering and scientific applications.(3) Cryogenics: Liquid helium’s extremely low temperature makes it uniquely qualified for use in cooling the superconducting magnets utilized in MRI scanners, NMR scanners, particle accelerators and nuclear fusion research .(4)(5) Technology Manufacturing Semiconductor manufacturing LCD Panels Fiber optics cables Healthcare & Life Sciences MRI Scanners Helium-ion microscopes Laser eye surgery Cryogenics Aerospace & Defense Space Exploration Fuel Purging Systems Defense and Rocket Guidance Systems Industrial Uses Welding, shield masks Gas leak detection Nuclear reactor coolant Crystal growth Mission Critical Applications (1) Semiconductor Industry Association (SIA) to the U.S. Geological Survey (USGS) on Helium Supply Risk. (2) U.S. Department of the Interior Bureau of Land Management. (3) The Institute for Energy Research (IER), Washington D.C. (4) Siemens Healthineers: The Liquid Gold of MRI. (5) NASA: NASA Awards Agency-wide Helium Contract. |

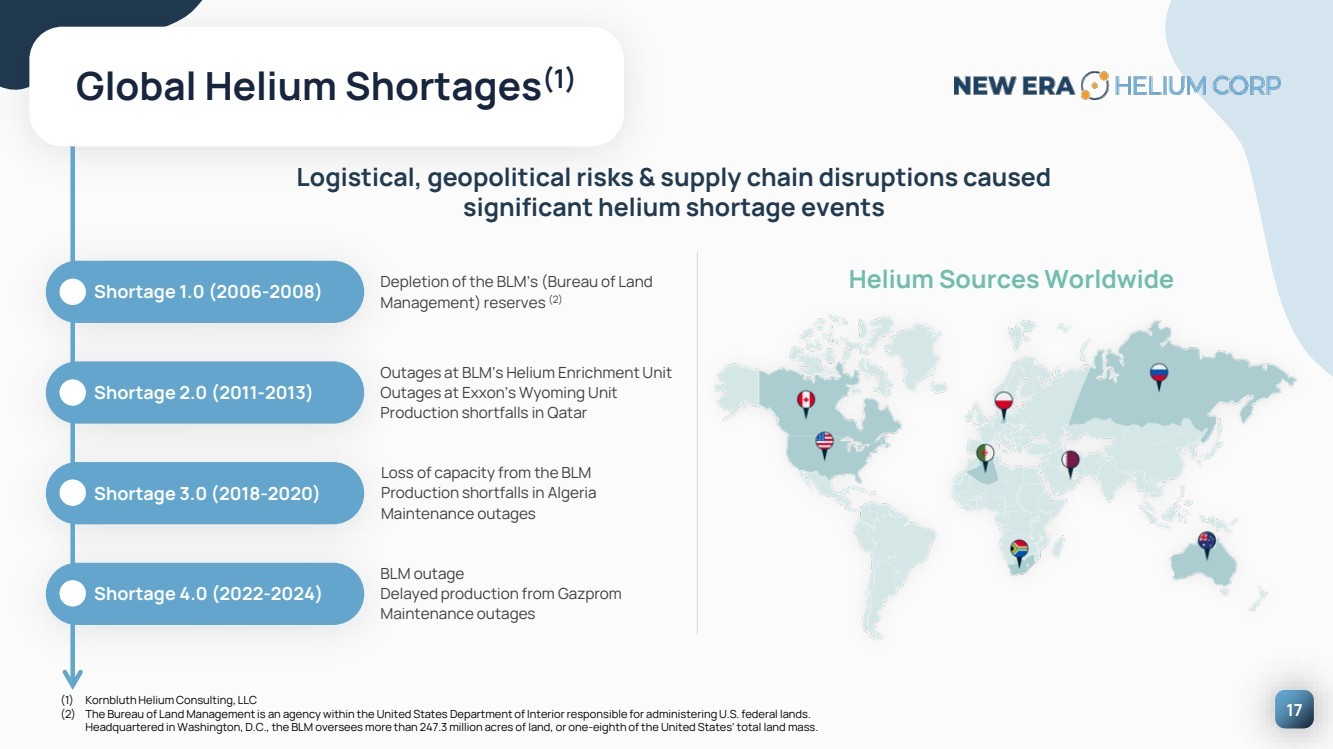

| 17 Shortage 1.0 (2006-2008) Shortage 2.0 (2011-2013) Shortage 3.0 (2018-2020) Shortage 4.0 (2022-2024) Global Helium Shortages(1) Logistical, geopolitical risks & supply chain disruptions caused significant helium shortage events 17 Depletion of the BLM’s (Bureau of Land Management) reserves (2) Outages at BLM’s Helium Enrichment Unit Outages at Exxon’s Wyoming Unit Production shortfalls in Qatar Loss of capacity from the BLM Production shortfalls in Algeria Maintenance outages BLM outage Delayed production from Gazprom Maintenance outages Helium Sources Worldwide (1) Kornbluth Helium Consulting, LLC (2) The Bureau of Land Management is an agency within the United States Department of Interior responsible for administering U.S. federal lands. Headquartered in Washington, D.C., the BLM oversees more than 247.3 million acres of land, or one-eighth of the United States’ total land mass. |

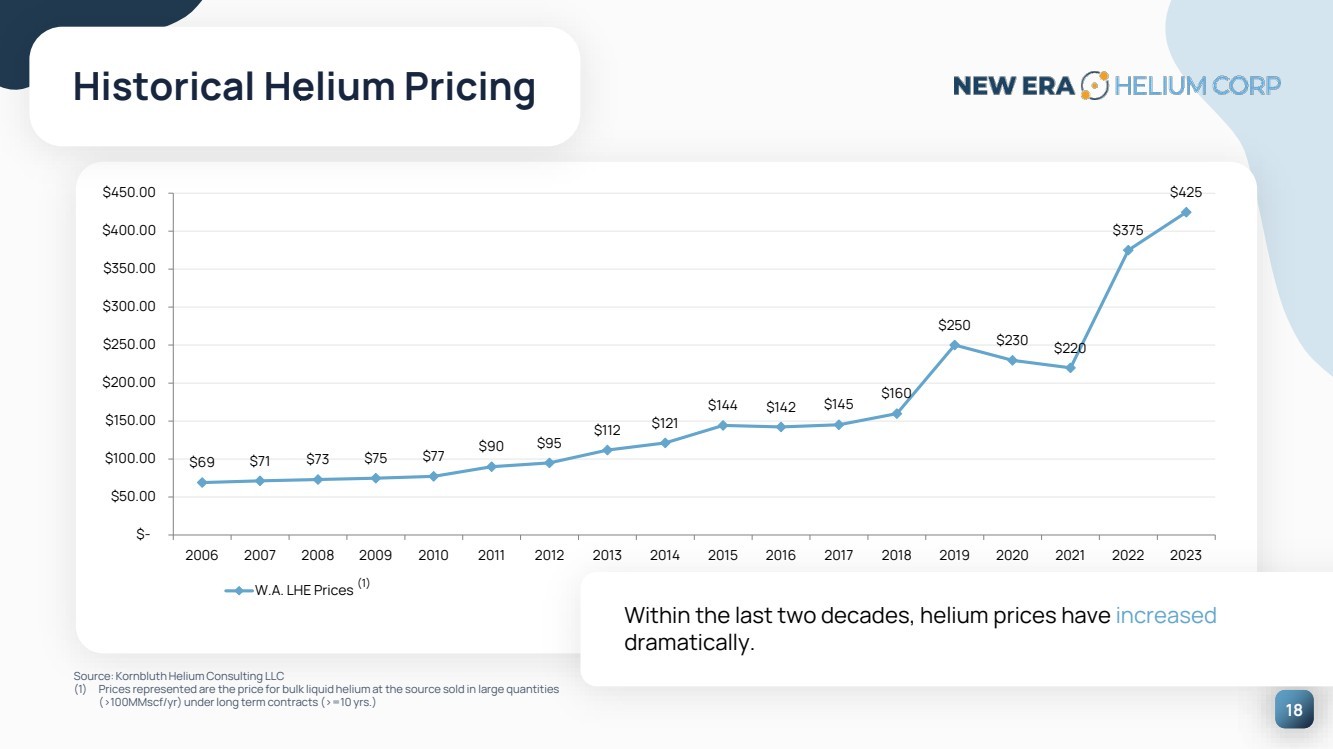

| 18 Historical Helium Pricing Source: Kornbluth Helium Consulting LLC (1) Prices represented are the price for bulk liquid helium at the source sold in large quantities (>100MMscf/yr) under long term contracts (>=10 yrs.) (1) Within the last two decades, helium prices have increased dramatically. $69 $71 $73 $75 $77 $90 $95 $112 $121 $144 $142 $145 $160 $250 $230 $220 $375 $425 $- $50.00 $100.00 $150.00 $200.00 $250.00 $300.00 $350.00 $400.00 $450.00 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 W.A. LHE Prices |

| 19 Helium’s Well-Established U.S. Supply Chain will Provide New Era with Global Market Access Access to Tier-1 Players Established Supply Chain Reliable Market Supplier New Era has a reliable supply of helium available for processing. (1) The Pecos Slope Plant in Southeastern New Mexico in the Permian Basin allows New Era to produce gaseous helium for sale to major players or liquefaction. Large helium distributors have an existing network to ship New Era’s helium to global markets. Extraction from Gas Fields Purification at Helium Plant Liquefaction at Keyes Helium Ship to Major Distributors Helium has been listed on the critical materials list of major economies such as the United States, the European Union, and mainland China because it is critical to strategic industries and at high risk of supply shortages.(2) A helium tolling agreement, enables NEH to produce liquid helium and facilitates access to a global market. (1) Reliability is based upon NEH’s 3rd party validation of our 1P and 2P helium reserves as of 12/31/23 (2) IHS Chemical. Helium Economics Handbook (CEH); April 2022 |

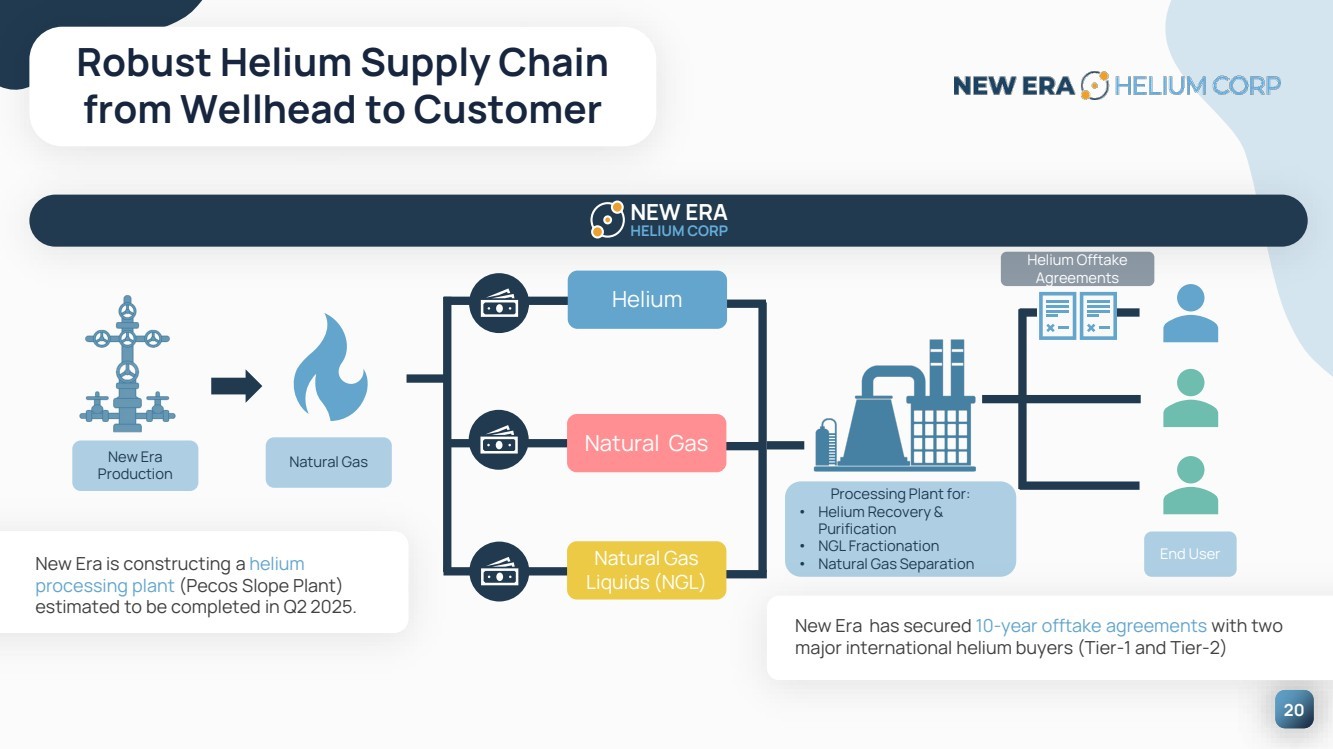

| 20 Robust Helium Supply Chain from Wellhead to Customer NEW ERA HELIUM CORP Helium Offtake Agreements Helium Natural Gas Natural Gas Liquids (NGL) Processing Plant for: • Helium Recovery & Purification • NGL Fractionation • Natural Gas Separation Natural Gas New Era Production New Era is constructing a helium processing plant (Pecos Slope Plant) estimated to be completed in Q2 2025. New Era has secured 10-year offtake agreements with two major international helium buyers (Tier-1 and Tier-2) End User |

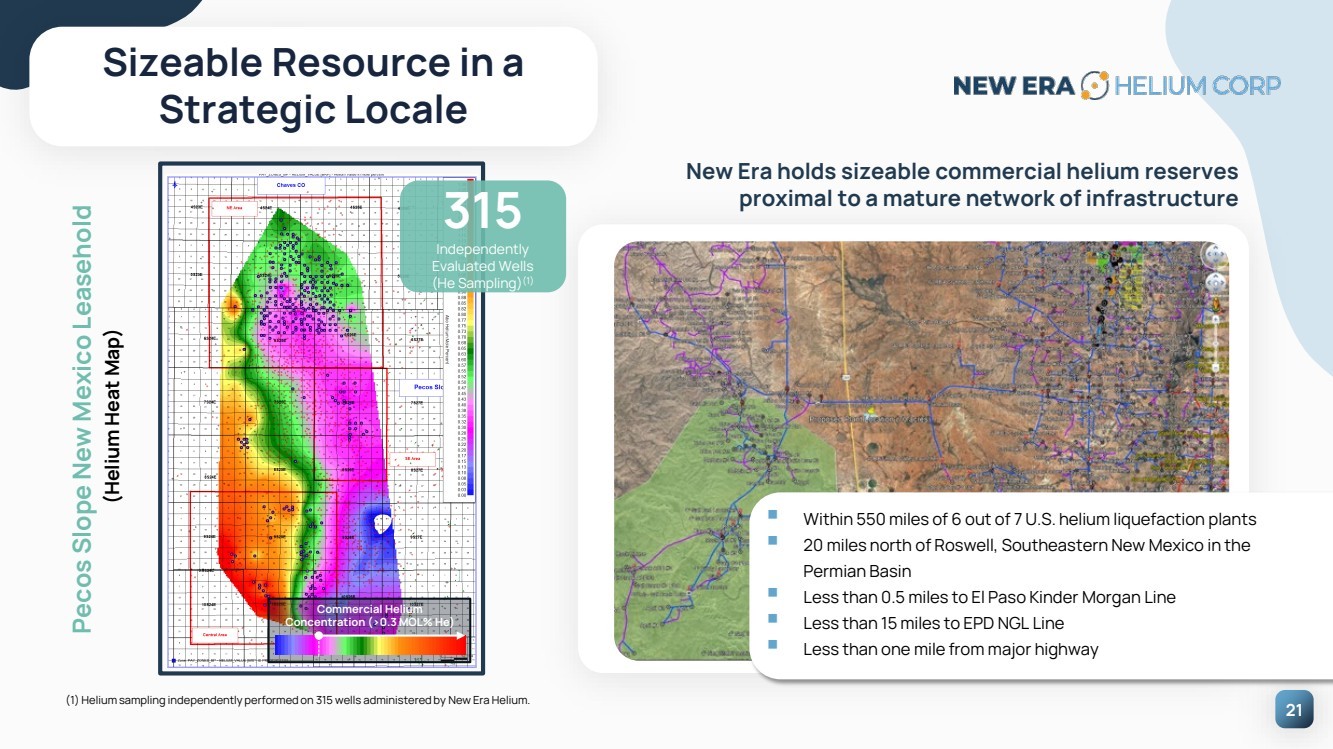

| 21 Pecos Slope New Mexico Leasehold New Era holds sizeable commercial helium reserves proximal to a mature network of infrastructure Sizeable Resource in a Strategic Locale (Helium Heat Map) Within 550 miles of 6 out of 7 U.S. helium liquefaction plants 20 miles north of Roswell, Southeastern New Mexico in the Permian Basin Less than 0.5 miles to El Paso Kinder Morgan Line Less than 15 miles to EPD NGL Line Less than one mile from major highway Commercial Helium Concentration (>0.3 MOL% He) 315 Independently Evaluated Wells (He Sampling)(1) (1) Helium sampling independently performed on 315 wells administered by New Era Helium. |

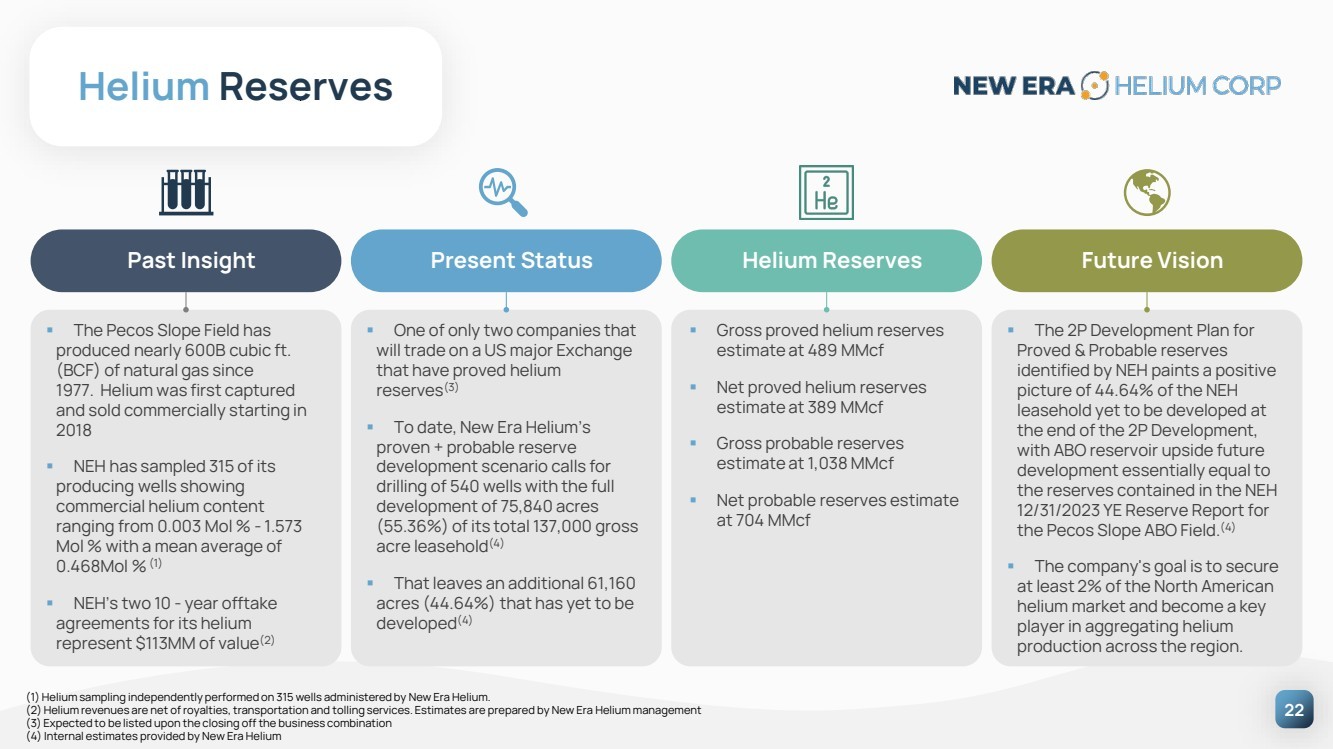

| 22 Helium Reserves (1) Helium sampling independently performed on 315 wells administered by New Era Helium. (2) Helium revenues are net of royalties, transportation and tolling services. Estimates are prepared by New Era Helium management (3) Expected to be listed upon the closing off the business combination (4) Internal estimates provided by New Era Helium Past Insight The Pecos Slope Field has produced nearly 600B cubic ft. (BCF) of natural gas since 1977. Helium was first captured and sold commercially starting in 2018 NEH has sampled 315 of its producing wells showing commercial helium content ranging from 0.003 Mol % - 1.573 Mol % with a mean average of 0.468Mol %(1) NEH’s two 10 - year offtake agreements for its helium represent $113MM of value(2) Present Status One of only two companies that will trade on a US major Exchange that have proved helium reserves(3) To date, New Era Helium’s proven + probable reserve development scenario calls for drilling of 540 wells with the full development of 75,840 acres (55.36%) of its total 137,000 gross acre leasehold(4) That leaves an additional 61,160 acres (44.64%) that has yet to be developed(4) Future Vision The 2P Development Plan for Proved & Probable reserves identified by NEH paints a positive picture of 44.64% of the NEH leasehold yet to be developed at the end of the 2P Development, with ABO reservoir upside future development essentially equal to the reserves contained in the NEH 12/31/2023 YE Reserve Report for the Pecos Slope ABO Field. (4) The company's goal is to secure at least 2% of the North American helium market and become a key player in aggregating helium production across the region. Helium Reserves Gross proved helium reserves estimate at 489 MMcf Net proved helium reserves estimate at 389 MMcf Gross probable reserves estimate at 1,038 MMcf Net probable reserves estimate at 704 MMcf |

| 23 Attractive Long-Term Offtake Agreements in Place with Major Helium Buyers Helium Offtake Agreements Buyer Agreement #1 Tier 1 Gas Co. Agreement #2 Tier 2 Gas Co. Term 10 Years 10 Years Quantity 50% : (16.4-18.0) MMSCF/ yr 50% : (16.4-18.0) MMSCF/ yr Mode of Delivery Bulk Gaseous Helium Bulk Liquid Helium Price Market Rate, Ex Works Market Rate, Ex Works, Liquefier Price Adjustment U.S. CPI U.S. CPI Floor Price ~75% - 1st 5 years 70% of Initial Price Price Reopeners After Yr 3 After Yr 3 Prepayment N/A $2MM |

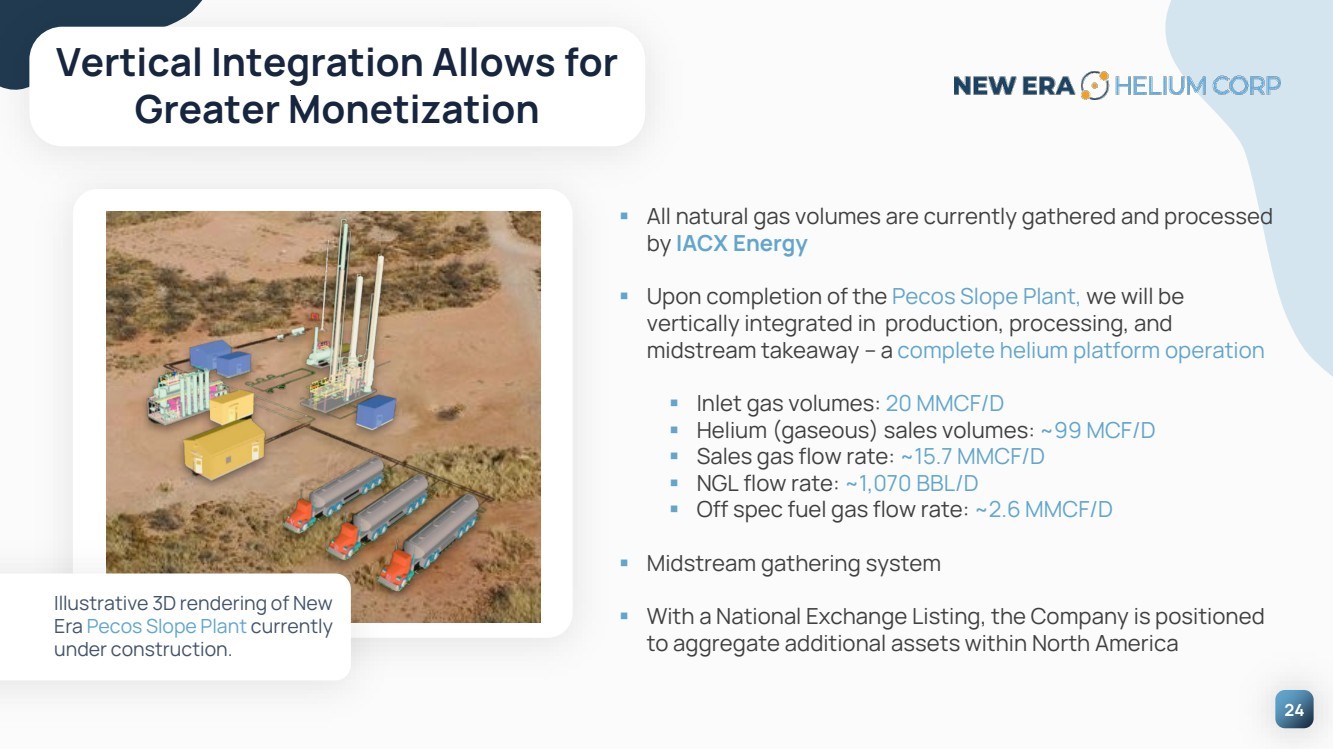

| 24 Vertical Integration Allows for Greater Monetization All natural gas volumes are currently gathered and processed by IACX Energy Upon completion of the Pecos Slope Plant, we will be vertically integrated in production, processing, and midstream takeaway – a complete helium platform operation Inlet gas volumes: 20 MMCF/D Helium (gaseous) sales volumes: ~99 MCF/D Sales gas flow rate: ~15.7 MMCF/D NGL flow rate: ~1,070 BBL/D Off spec fuel gas flow rate: ~2.6 MMCF/D Midstream gathering system With a National Exchange Listing, the Company is positioned to aggregate additional assets within North America Illustrative 3D rendering of New Era Pecos Slope Plant currently under construction. |

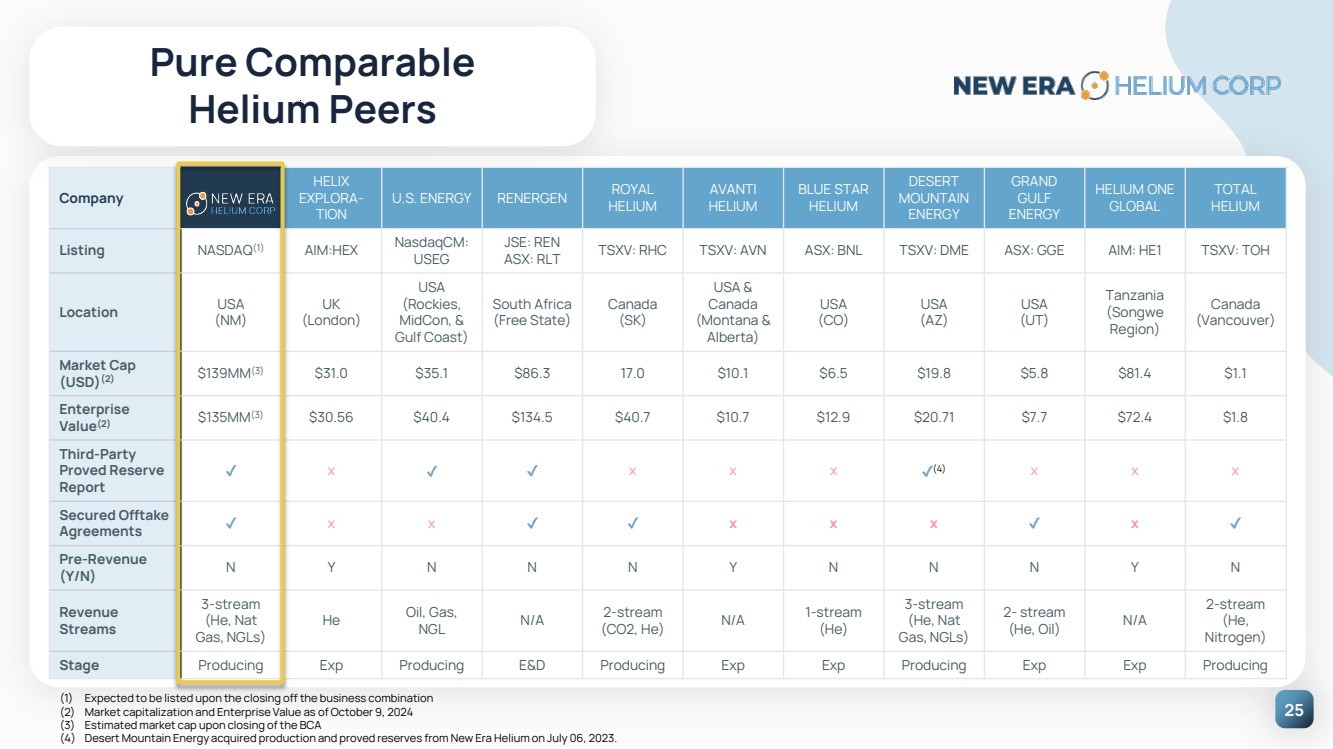

| 25 Pure Comparable Helium Peers Company HELIX EXPLORA-TION U.S. ENERGY RENERGEN ROYAL HELIUM AVANTI HELIUM BLUE STAR HELIUM DESERT MOUNTAIN ENERGY GRAND GULF ENERGY HELIUM ONE GLOBAL TOTAL HELIUM Listing NASDAQ(1) AIM:HEX NasdaqCM: USEG JSE: REN ASX: RLT TSXV: RHC TSXV: AVN ASX: BNL TSXV: DME ASX: GGE AIM: HE1 TSXV: TOH Location USA (NM) UK (London) USA (Rockies, MidCon, & Gulf Coast) South Africa (Free State) Canada (SK) USA & Canada (Montana & Alberta) USA (CO) USA (AZ) USA (UT) Tanzania (Songwe Region) Canada (Vancouver) Market Cap (USD)(2) $139MM(3) $31.0 $35.1 $86.3 17.0 $10.1 $6.5 $19.8 $5.8 $81.4 $1.1 Enterprise Value(2) $135MM(3) $30.56 $40.4 $134.5 $40.7 $10.7 $12.9 $20.71 $7.7 $72.4 $1.8 Third-Party Proved Reserve Report x x x x (4) x x x Secured Offtake Agreements x x x x x x Pre-Revenue (Y/N) N Y N N N Y N N N Y N Revenue Streams 3-stream (He, Nat Gas, NGLs) He Oil, Gas, NGL N/A 2-stream (CO2, He) N/A 1-stream (He) 3-stream (He, Nat Gas, NGLs) 2- stream (He, Oil) N/A 2-stream (He, Nitrogen) Stage Producing Exp Producing E&D Producing Exp Exp Producing Exp Exp Producing (1) Expected to be listed upon the closing off the business combination (2) Market capitalization and Enterprise Value as of October 9, 2024 (3) Estimated market cap upon closing of the BCA (4) Desert Mountain Energy acquired production and proved reserves from New Era Helium on July 06, 2023. |

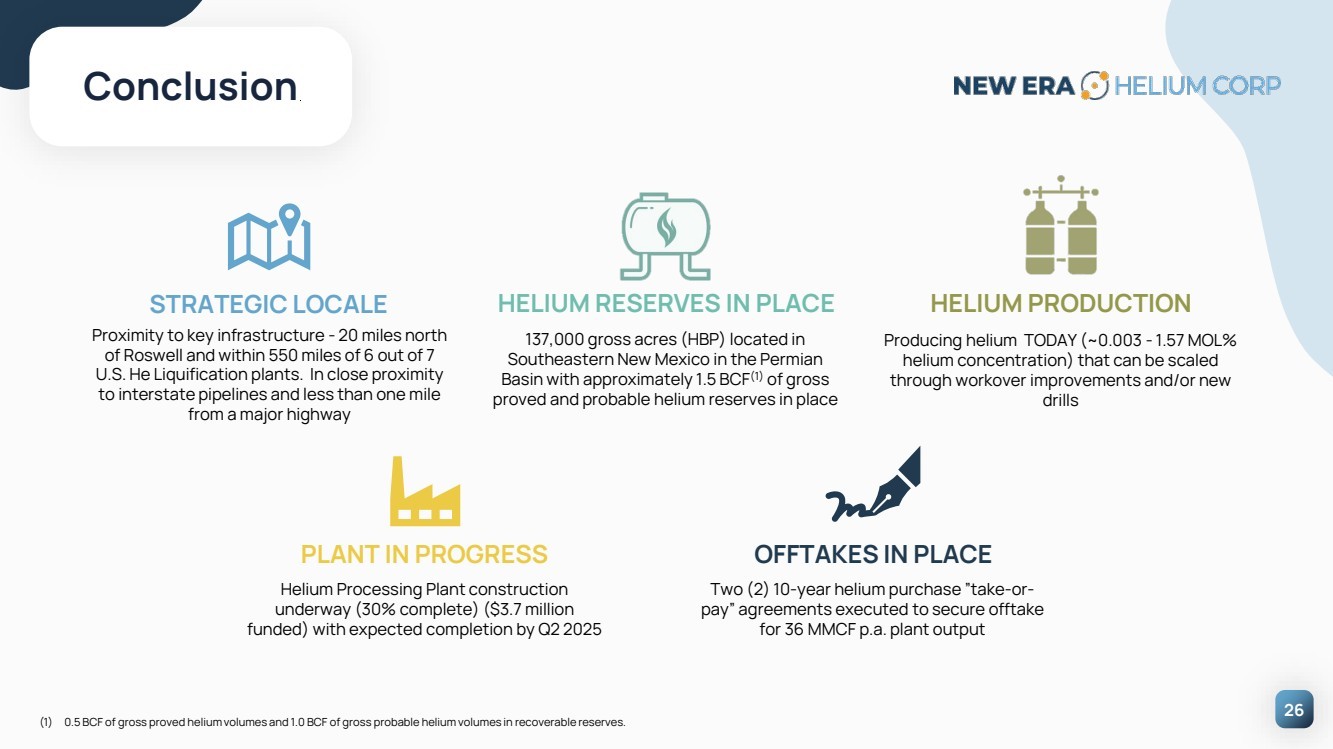

| 26 Conclusion STRATEGIC LOCALE Proximity to key infrastructure - 20 miles north of Roswell and within 550 miles of 6 out of 7 U.S. He Liquification plants. In close proximity to interstate pipelines and less than one mile from a major highway HELIUM PRODUCTION Producing helium TODAY (~0.003 - 1.57 MOL% helium concentration) that can be scaled through workover improvements and/or new drills PLANT IN PROGRESS Helium Processing Plant construction underway (30% complete) ($3.7 million funded) with expected completion by Q2 2025 OFFTAKES IN PLACE Two (2) 10-year helium purchase ”take-or-pay” agreements executed to secure offtake for 36 MMCF p.a. plant output HELIUM RESERVES IN PLACE 137,000 gross acres (HBP) located in Southeastern New Mexico in the Permian Basin with approximately 1.5 BCF(1) of gross proved and probable helium reserves in place (1) 0.5 BCF of gross proved helium volumes and 1.0 BCF of gross probable helium volumes in recoverable reserves. |

| 27 APPENDIX |

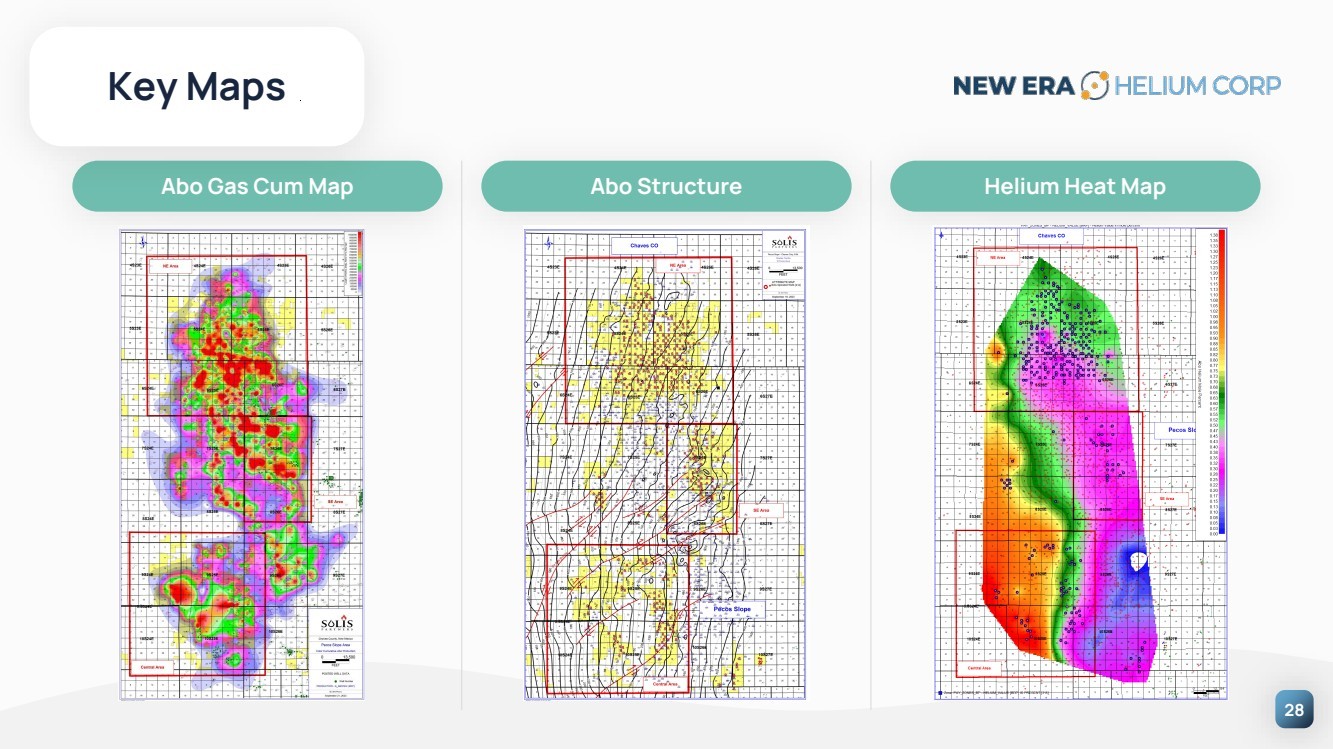

| 28 Abo Gas Cum Map Abo Structure Helium Heat Map Key Maps |

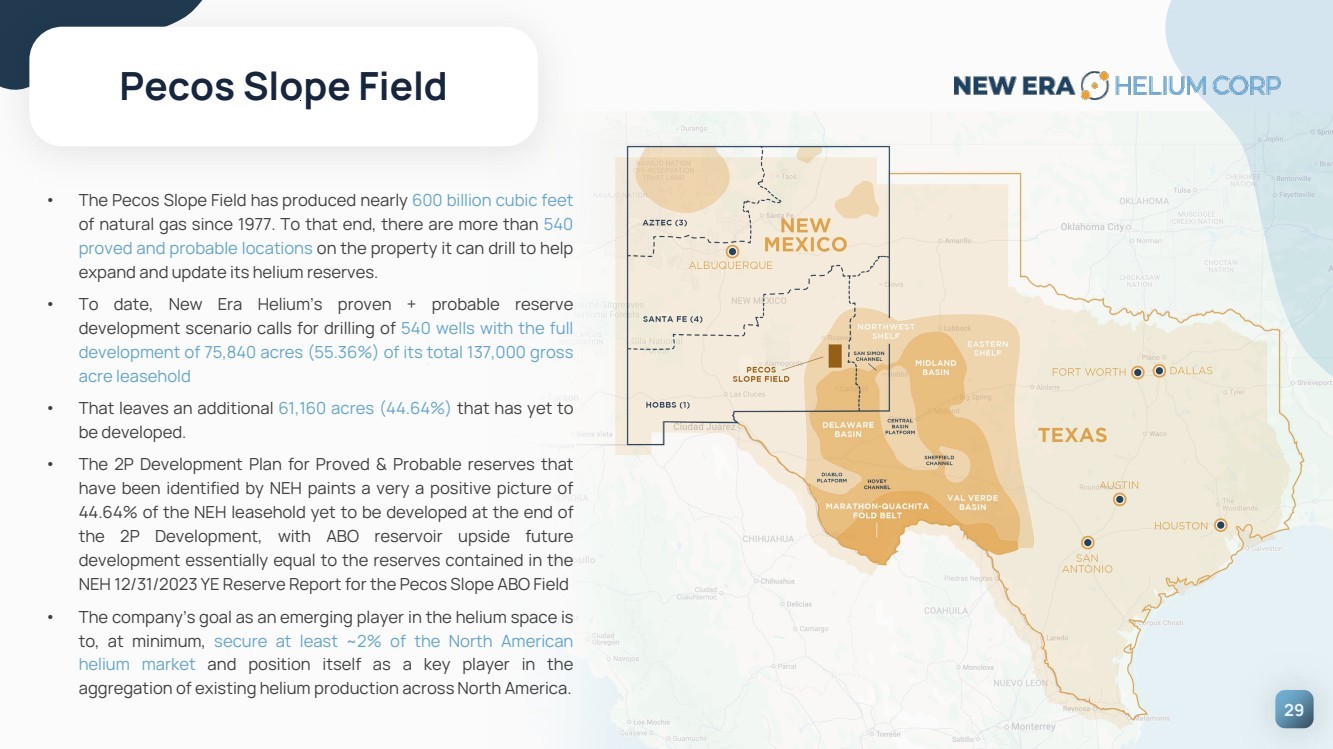

| 29 NEW ERA AT A GLANCE Pecos Slope Field • The Pecos Slope Field has produced nearly 600 billion cubic feet of natural gas since 1977 .. To that end, there are more than 540 proved and probable locations on the property it can drill to help expand and update its helium reserves .. • To date, New Era Helium’s proven + probable reserve development scenario calls for drilling of 540 wells with the full development of 75 ,840 acres (55 ..36 % ) of its total 137 ,000 gross acre leasehold • That leaves an additional 61 ,160 acres (44 ..64 % ) that has yet to be developed .. • The 2 P Development Plan for Proved & Probable reserves that have been identified by NEH paints a very a positive picture of 44 ..64 % of the NEH leasehold yet to be developed at the end of the 2 P Development, with ABO reservoir upside future development essentially equal to the reserves contained in the NEH 12 /31 /2023 YE Reserve Report for the Pecos Slope ABO Field • The company’s goal as an emerging player in the helium space is to, at minimum, secure at least ~ 2 % of the North American helium market and position itself as a key player in the aggregation of existing helium production across North America .. |